Is your business fully aware of its vulnerability to money laundering and terrorism financing risks?

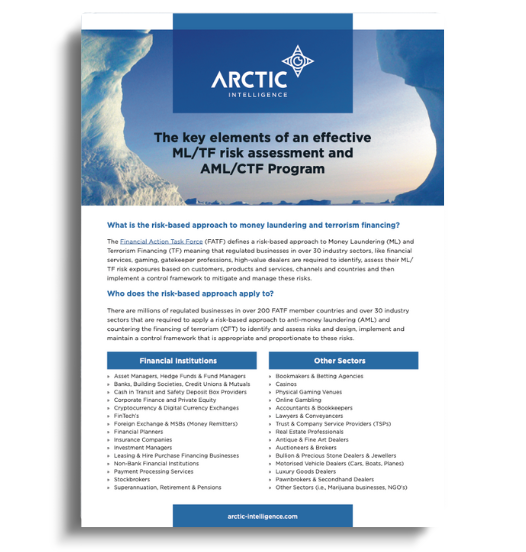

As you know, money laundering and terrorism financing laws are risk-based. This means that regulated businesses like yours must conduct business-wide ML/TF risk assessments. The aim is to identify and assess the risks where businesses might be exploited by organised criminal networks, laundering the proceeds of their crimes.

If your business is used to launder criminal funds, your business could face significant penalties. Financial crime regulators like have been granted extensive powers to enforce non-compliance with AML/CTF laws.

At the heart of any effective AML/CTF Program comes a clear understanding of how your business could be exploited by organised criminal networks. This understanding hinges on various factors, including the products and services offered, the channels these are distributed through, the types of customers your business deals with and the exposure to certain countries.

Does your business understand its risk exposure to money laundering and terrorism financing?

Many small and medium-sized businesses have the same compliance obligations as larger ones but often lack the resources and in-house expertise to develop ML/TF risk assessments or design, implement and maintain effective AML/CTF Programs.

Sound familiar? If so, you’re not alone, so Arctic Intelligence have created this factsheet on the key elements of an effective ML/TF risk assessment and AML/CTF Program for you to download.

How AML Accelerate can help assess your ML/TF risks and build an effective AML/CTF Program.

AML Accelerate has been designed by financial crime experts specifically for small and medium-sized companies in over 30 sectors and over 50 countries to help guide them to conduct business-wide money laundering and terrorism financing risk assessments, document AML/CTF Programs and track and monitor issues, breaches and incidents in real-time.

Get started with an obligation-free 14-day trial of AML Accelerate today!

Sign up for your obligation-free 14-day trial to AML Accelerate and get access to our multi-award winning platform used by hundreds of companies just like yours to conduct business-wide money laundering and terrorism financing risk assessments tailored to your sector and AML/CTF laws in (and many others).