Investors flock to Sharesight’s portfolio tracker amid retail investing revolution

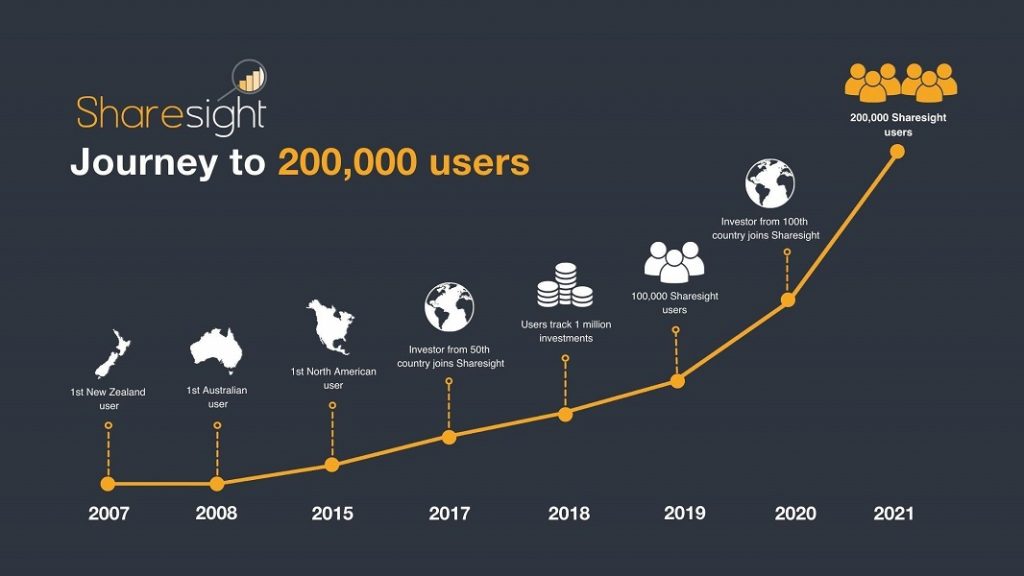

Portfolio tracking software company Sharesight has experienced rapid growth over the past 18 months, reaching more than 200,000 global users – a 100% increase in the platform’s user base. This comes at a time of heightened volatility in global markets, with many investors searching for tools that will give them a clearer picture of their investments.

According to Sharesight CEO Doug Morris, now is an exciting time for the platform, which is a comprehensive online portfolio tracking solution that offers automatic holding updates, performance and tax reports for investors. The platform is experiencing unprecedented growth in its international user base in particular, and has been expanding its offices in Australia and New Zealand to keep pace with demand.

“As a bootstrapped company from New Zealand, it took us a while to reach 100,000 users, yet only 18 months to get from 100,000 to 200,000,” says Morris.

“We attribute this rapid growth to the significant investments we’ve made in our product and marketing teams following a successful capital raising in early 2020, alongside an increased appetite for investing due to the prevailing conditions globally.”

With Sharesight’s surge in users expected to continue throughout 2021 and beyond, there are extensive plans on the horizon to enhance the user experience for global investors, according to Morris.

“We have big plans for our core offering for Australian and New Zealand customers while we build out our product for international users. There has been a large influx of users from the US, Canada, Hong Kong, Singapore and the UK in particular, and we are working on further enhancing our software to meet the needs of these global investors.”

With people around the world turning their hand at investing to build wealth, this creates a real need for an online portfolio tracking solution that will give people clarity on their investments, adds Sharesight Chief Customer Officer, Jessica Goodall.

“Our accelerated growth is indicative of a growing need for transparency among investors,” says Goodall.

“Now more than ever, experienced and new investors require accuracy and impartiality and are turning to platforms like Sharesight to empower them to make better investment decisions.”

Sharesight is currently used by over 200,000 investors in 103 different countries, who are tracking more than 2.5 million investment holdings.