Identitii has joined the global NICE Actimize X-Sight Marketplace

ASX-listed Identitii announce that it has joined the NICE Actimize X-Sight Marketplace, which matches technology providers with financial institutions searching for innovative financial crime solutions, including anti-money laundering and counter-terrorist financing (AML/CTF).

The NICE Actimize X-Sight Marketplace is the first financial crime ecosystem that connects financial institutions with technology providers offering data, applications, and tools. Identitii’s AUSTRAC reporting platform, which will be offered through the X-Sight Marketplace, can be integrated into the NICE Actimize financial crime solutions suite.

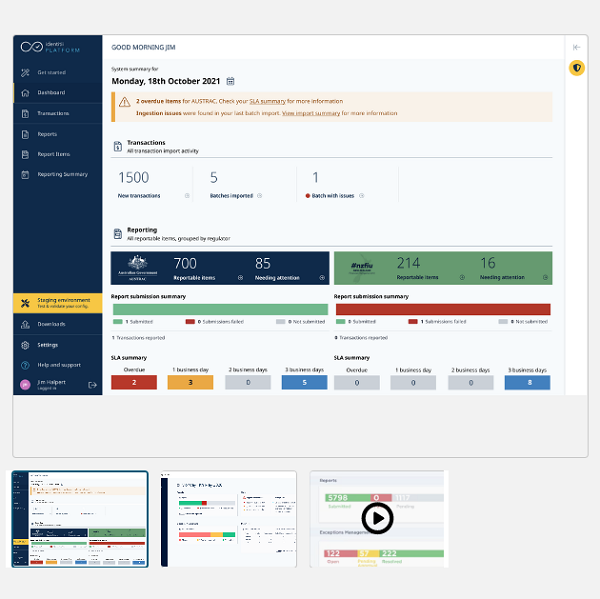

Further augmenting NICE Actimize’s solutions for the Australian market, Identitii’s software-as-a-service Regulatory Reporting platform helps financial institutions automate complete and accurate AML/CTF reporting to reduce the risk of non-compliance with financial crime regulations. Initially available for AUSTRAC reporting in Australia, the Identitii platform easily adapts for regulatory requirements in other countries, with New Zealand and Canada among the jurisdictions to be added soon.

Commenting on the announcement, John Rayment, CEO of Identitii, said, “How financial institutions purchase technology is changing, with a shift to buying best of breed solutions that connect using the cloud to solve complex problems. The X-Sight Marketplace is a unique place for these customers to search for and connect with technology solutions that are complimentary to their existing infrastructure, which makes it a unique place to solve financial crime compliance challenges quickly and easily. We are thrilled to join the X-Sight Marketplace and to work closely with NICE Actimize to bring automated regulatory reporting to their customers in Australia and around the world.”

Technology providers that join NICE Actimize’s X-Sight Marketplace ecosystem are reviewed for their ability to complement financial crime and compliance solutions. Once approved, software and service providers become available to the NICE Actimize community via the X-Sight Marketplace. Financial institutions can quickly browse through X-Sight Marketplace solution categories to find scalable options that solve their unique business problems.

The Identitii platform provides reporting entities with visibility over what has and has not been reported, and overcomes the challenges associated with using spreadsheets to manage compliance, significantly reducing the amount of manual processing needed to identify, collect, and submit suspicious activity, international transfer, and large cash transaction reports to regulators. It delivers end-to-end automation of AML/CTF reporting and future proofs compliance by accepting any payment file format used today as well as offering transformation from SWIFT FIN files to the new global ISO 20022 standard.

Identitii’s listing has gone live on the NICE Actimize X-Sight Marketplace today and can be viewed here.