How Australians can soon take back control of their identity

Renting your first apartment is a rite of passage for young Australians – one that traditionally leads to independence, security and belonging. It can also now lead to identity fraud, according to John Shepherd, Leading the Federal Government’s Digital ID Taskforce in the latest episode of the Australian Payments Plus Point of View (AP+ POV) blog.

“My son’s just moved,” Shepherd said. “He’s just finished uni and moved to Sydney to rent a little place in Redfern, and as part of that, him and his girlfriend needed a couple of guarantors to go on the rental application because they were just moving into full-time work.

“I was sent a link to a rental app where I needed to provide three pay slips, my bank statement with transactions, balances, and a hundred points of ID.”

Shepherd, who is leading the Federal Government’s Digital ID Taskforce, immediately saw the risk but had to comply if his son was to have any chance of making a successful application.

“This app’s not accredited,” Shepherd said. “There’s no regulator who knows who the data’s been shared with, how long it’s been stored, how it’s protected. I just know there’s way, way, way too much data being collected off people and you’re not in control of it.”

Small businesses are now holding potentially hundreds of thousands of identity documents in unregulated storage, representing a new type of honey pot for cyber-criminals.

High profile breaches at major companies regularly dominate today’s headlines. Australians lost a reported $33 billion to cybercrime in 2020-21, although the unreported figure is almost certainly much higher.

Enter Digital ID

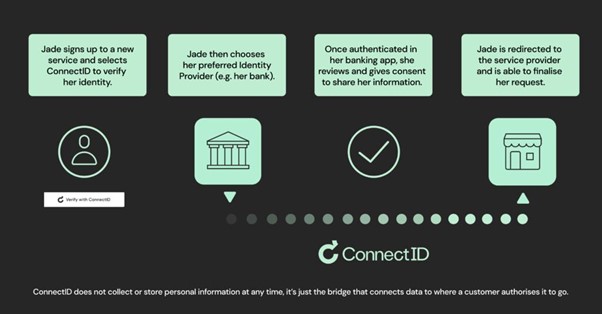

The government’s answer is a national Digital ID scheme, which will be implemented by December 1, 2024 after the Digital ID Bill passed Parliament in May. Digital ID will offer a convenient online method for Australians to verify their identity against the official record held by various government agencies rather than handing over passports and driver’s licenses.

ConnectID Managing Director Andrew Black says many businesses have retained identity data ‘just in case’ they need it, although attitudes were now changing.

“There’s a real education piece to do with different sectors and industries who have inherited practices to just stop and check if that’s the case, and then educating consumers on the tools they can use to have more control over that data,” Black says.

A key part of that education has been recognising that Australians want a choice of Digital ID providers rather than being forced to use one government-mandated system. Australian Payments Plus’ ConnectID is the first private sector digital identity exchange to be accredited under the regime.

“We think this is better for people to have more control, but it is a voluntary system and it’s ultimately about you choosing your relationships,” Black said.

The Digital ID legislation allows accredited providers to use a trust mark to show they’ve met the required standard of security and privacy.

Accessibility needed to bring Digital ID benefits to all

The economic potential of Digital ID could equal 3-4 per cent of Australia’s GDP according to the McKinsey Global Institute. However, accessibility remains a key concern if those benefits are to flow equally to all Australians.

“It’s about truly making it a digital economy and having an inclusive digital economy,” Black said. “Thinking about those in remote communities and particularly those of our First Nations Australians who don’t perhaps fit into today’s 100-point check bucket, and making sure that we don’t just replicate that system online.”

Shepherd said it was another reason that the private sector was needed in the Digital ID rollout. For example, few blind or vision-impaired people have a driver’s licence or passport, which makes the myGov ID registration process difficult. Meanwhile, just over half of all Australians have a passport, which is required to create a strong MyGov ID.

“It’s very hard for one provider to meet everybody’s needs and to be fit for purpose, for all the kinds of different uses and use cases that we talk about for Digital ID,” Shepherd said. “I think there’s a massive opportunity for seeing providers come forward to tailor their solutions to certain segments of the community.”

The private sector could also provide some insurance against a single point of failure.

The Nordic nations are perhaps the leading example of a successful Digital ID system built by private and public partners. About 80 per cent of Norwegians (or 4.3 million people) have a BankID, which was first launched about two decades ago.

It provides an indication of where Australia will soon be with simpler and safer ID processes. Handing over paper-based ID documents – including for rental applications – will likely be consigned to the wastepaper basket of history.

“I’m incredibly excited at the prospect of never having to scan a photocopy of my passport or driver’s licence or handing it over to somebody and hoping it’s in some secure filing cabinet somewhere,” Black ended.