GoCardless: tapping the fintech opportunity in Australia with bank-to-bank payments

GoCardless is a global fintech firm founded in the UK, offering innovative digital bank-to-bank payment solutions. The company entered Australia in 2018 and has clocked impressive growth within a short period, among small businesses and large enterprises.

In this case study, Joseph Robins, Senior Account Executive for Australia & New Zealand discusses the company’s journey so far, including:

- The company’s operating model and global success

- The opportunities for global fintech firms in Australia

- The role of Austrade as a facilitator.

With over 60,000 businesses as customers GoCardless currently processes $20 billion in transactions every year. And despite a challenging 2020, the company continued its Australia growth story with strong growth in revenues, merchant partners and customer wins.

Revolutionising global payments with open banking from Australia

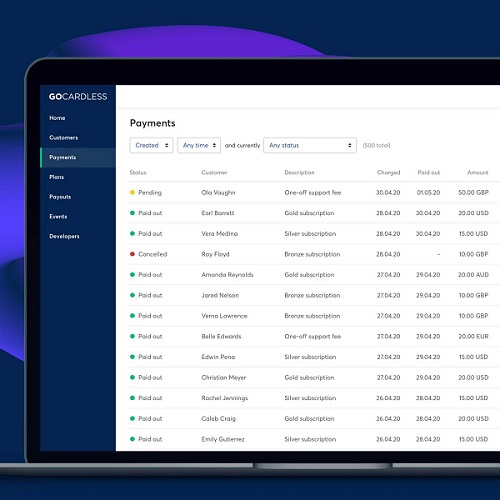

GoCardless is on a mission to help businesses with recurring revenue manage their receivables by enabling bank-to-bank debit.

The company helps customers improve their cash flow by automating administrative tasks and payment reconciliation across billing platforms. Besides lowering failure rates to as little as 0.5%, GoCardless helps customers bypass high transaction fees levied on debit and credit card payments.

‘Our solutions allow customers to save costs, and merchants to reduce involuntary churn by decreasing payment failures,’ says Robins. ‘Combined with enhanced and seamless cash flow, GoCardless is committed to helping large and small businesses in Australia deal with delayed payments.’

GoCardless currently has over 60,000 business customers across the UK, US, Europe, Australia and New Zealand. It processes $20 billion in transactions every year. To scale up its operations further – and to accelerate its open banking strategy – the company raised its largest round of funding in late 2020, worth $95 million.

Finding roots and scaling-up in Australia

GoCardless has strengthened its presence in the Australian market within a short period of three years. ‘Despite a challenging 2020, we have reported a massive growth in revenue and an exponential growth in headcount,’ says Robins.

‘Additionally, as Australian companies realise the benefits of bank-to-bank debit, businesses of all shapes and sizes see the value in a cost-effective, seamless, and reliable payments system. As a result, we are also witnessing an uptick in active merchants on our platform and customer sign-ups. This has helped us scale up effectively.’

To read more, please click on the link below…

Source: GoCardless: tapping the fintech opportunity in Australia with bank-to-bank payments – Austrade