Global trends and opportunities in B2B payments: A look into how businesses can take advantage of automated digital solutions to accelerate growth.

Digital payments have helped businesses get paid safely and efficiently through the COVID-19 lockdowns and associated restrictions, but new challenges are arising as economies reopen. With supply chain disruptions, the ‘great resignation’, rising inputs such as fuel, and the expense of reopening top of mind for businesses, now is an opportune time to build on the processes optimised throughout the pandemic, especially across B2B trade.

Transforming payment processes with digital technology not only helps businesses get paid faster but implementing integrated cloud-based solutions delivers many efficiency-based benefits for businesses. Which is why Spenda, a leader in B2B payment and lending solutions, leveraged extensive research to create a paper that delivers a holistic overview of insights into the global state of B2B payments and how businesses can take advantage of trends and innovations to accelerate growth.

Spenda’s CEO, Adrian Floate said: “Businesses pay late for many reasons, most commonly because cash flow is hampered as a result of ageing receivables. While regulatory changes and Government incentives are a valid step and may reduce payment times, they don’t resolve the root cause of late payments.”

“Implementing the right technology can address late and non-payment risk at its root while transforming how businesses manage their finances from credit management to accessing working capital,” he continues.

Trends and opportunities in B2B payments – Some highlights

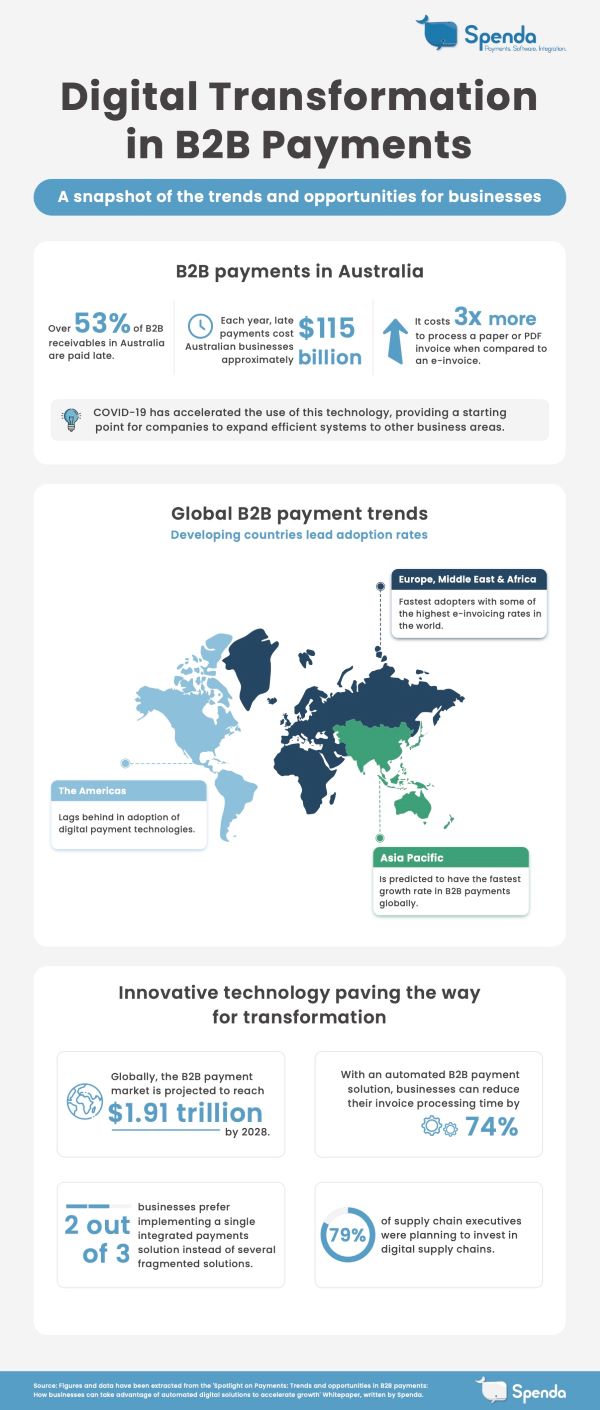

- Over half of Australia’s B2B payments are processed late, and it’s a major resource drain: More than 53% of B2B receivables in Australia are paid late. Not only do late payments cause cash flow problems, but chasing up these payments takes valuable time too.

- Global digital B2B payments trends: e-invoicing and virtual cards lead the way: Adoption rates of digital B2B payments technologies vary around the world. Currently, developing regions in Africa and South-East Asia are leading the way with growth driven by the uptake of innovations such as virtual cards and it’s projected that the global virtual card transaction value will reach $6.8 trillion by 2026.

- Mandates and Policies are a catalyst for digital adoption: In Australia for example, the 2022/23 Federal Budget cash flow promise and Payment Times Reporting Scheme are a valid step and may reduce payment times. Similarly, Governments around the world are planning to accelerate e-invoicing adoption for businesses in the coming years. And while this is a valid step and may reduce payment times, it doesn’t resolve the root cause of late payments and inefficiencies across the supply chain — outdated processes and payment infrastructure.

Floate added: “COVID-19 accelerated the use of smart technology in the supply chain, providing a starting point for companies to expand efficient systems to other business areas. Businesses that implement integrated technology solutions can better maximise their ROI while transforming systems and processes across the organisation. And it’s those companies that are proactive now that will gain a competitive edge, while experiencing lower costs and stronger financial management.”

For a copy of the full copy of Spenda’s report, please visit: https://spenda.co/trends-opportunities-in-b2b-payments/