Global online trading innovator moomoo making waves

Investment trading platform moomoo is shaking up online trading in Australia with a suite of trading tools unique to the market, as its parent company Futu Holdings Limited (Nasdaq: FUTU) continues to report significant global growth with its total revenue increasing 10.8% year-over-year to US$222.6 million, according to their Q2 Earnings Report released on August 30.

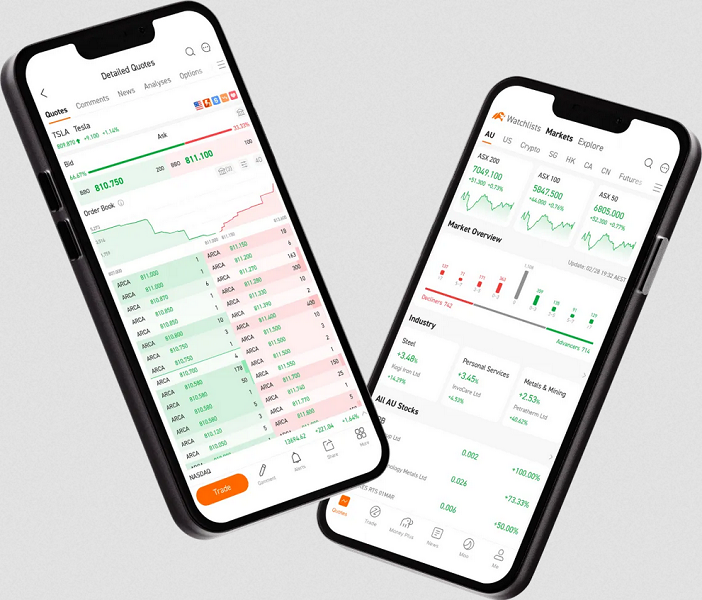

In just six months, moomoo has deployed several new trading features to assist stock selection and market access as well as broaden investor insights, demonstrating the agility of the platform in comparison to other market incumbents.

Additionally, the Business Data Insights feature brings business performance metrics beyond financial data, such as product sales and advertising revenue, to the forefront of the platform, supporting users to make more informed investments.

Introduction of features such as ‘Up/Down Colours’, which provides an alternative UI experience for users with colour blindness, support moomoo’s overall mission to make investing more accessible for Australian investors.

Futu Holdings Australia CEO and Head of Global Strategy Steve Zeng said moomoo is looking to provide a simple and superior investing experience to Australian users.

“We’re dedicated to providing the most technically advanced, highly customised and yet simple trading platform available to Australian retail investors, with our research and development team accounting for around 70% of moomoo and our parent company Futu’s total workforce,” Zeng said.

“To give Australian investors the best investment experience possible we are frequently introducing enhanced capabilities to the platform.”

“Our global successes and strength give us significant capacity to grow and evolve our platform, not just keeping with customer demand, but re-defining the trading experience and leading the industry for Australian investors.”

Other features have recently been added in response to market demand including Crypto ETFs, pre-open and pre-close price data, and an investor earnings calendar.

The customisable earnings calendar feature allows investors to track the reporting calendars, recent announcements and stock valuation of publicly traded companies expected to release investor information during earnings season.

Australian investors can use the moomoo app to trade stocks and ETFs listed on Australian and US markets, with the Hong Kong SAR market to be added soon.

Globally, Futu reported solid growth in Q2 with US$222.6 Million total revenue, and a 20% increase YoY to 18.6 million total users of moomoo and its sister brand Futubull.

The number of newly acquired moomoo and Futubull paying users in the second quarter was 61,000, with approximately 90% located in the United States, Hong Kong SAR, Singapore, and Australia markets. The quarterly client retention rate reached almost 99%.

By the end of the second quarter, total client assets amounted to US$55.3 billion (~AUD$81.09 billion), an increase of 12.3% from the previous quarter.