Global 2018 digital banking sales report finds Australia again leads the way

Avoka, the global leader in digital customer acquisition for financial services, today released its third annual Digital Sales Report which found that Australian banks continue to excel compared with their peers in North America and Europe.

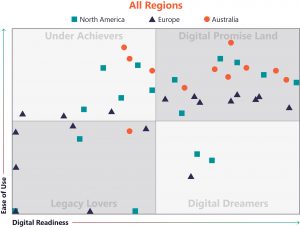

The report analysed the digital account opening capabilities of the 50 largest banks in these regions (32 in 2017) and found that as banks capitalise on opportunities in the face of increasingly stiff competition, Australian banks once again lead in digital readiness. Avoka’s study focused on breadth of offer and ease of use, with the capability of 11 Australian banks assessed in the report.

Commenting on the global findings, Avoka Chief Executive Phil Copeland said: “Banks have accepted that online account opening is a must have, not a ‘nice to have’.

“The focus now is on whether the largest banks can transform their entire customer engagement across all product lines including personal, business, and wealth, or is it limited to a marquee demonstration for just a few consumer products.”

Mr Copeland said banks worldwide will also face scrutiny for their ability “to create a cohesive experience that connects their branches, advisors, and their new digital investment”.

“Australian banks have led their global counterparts in offering digital sales in the past three years we have conducted this study, and the leadership continued in 2018. For personal banking, nearly every flagship product ranks high in quality of experience,” said Mr Copeland, who started the business in Manly in 2002.

Avoka’s report said every region made noticeable progress in business banking, the “most profitable and possibly most complex of all the product lines.

“Australia still leads, but the other regions are catching up. Business banking offers the best unexploited opportunity for digital leadership and improvement of customer experience,” the report stated.

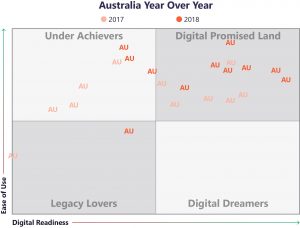

Avoka’s report found that among Australian banks the proportion of digitally enabled products continues to improve, with seven of the 11 local banks placed in the “Digital Promised Land” quadrant (six in 2017). By comparison, six US banks were in the top quadrant (three in 2017) while eight were from Europe (two in 2017). The other quadrants used in the global study consisted of “Under Achievers”, “Legacy Lovers” and “Digital Dreamers”.

Sales Readiness Matrix Results

2018 Global Report highlights:

- Business Banking took a leap forward

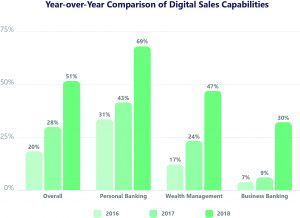

While still lagging far behind Personal and Wealth Management, Business Banking units woke up, with worldwide increases of 300% for online sales readiness. The Business Banking race is on.

- Mobile vs desktop

Mobile also took a big step forward, closing the gap with online desktop account opening that was in the range of 50% or more in prior studies. Today that gap has been reduced to approximately 20%.

- Europe vs North America and Australia

Geographical changes stood out this year, with North America overtaking Europe in overall digital sales capability, as well as momentum of the regional leaders. Expanded coverage highlighted country differences in Europe, with banks in certain countries hampered by regulatory constraints. But even for banks in prior years studies, the trajectory in Europe was flat. As usual, digital readiness in Australia leads them all.

- For their marquee deposit products, 42% of the banks have reached the Digital Promised Land, a significant improvement led by the US and Australia.

- Online account opening for personal banking products jumped to 69% of all products worldwide, more than double where it was two years ago.

- Mobile sales readiness in the US and Australia increased 50% in the past year. The biggest players in these regions are taking swift action on mobile, while European counterparts moved much more slowly.

Other Australian Findings:

- Mobile First Is Almost De Facto in Australia

Mobile account opening is now available for over half the banking products of all types in Australia, again leading in this worldwide study.

- Personal Banking products remain in the lead

More than 65% of products in Australia now have this capability, double where it was two years ago.

- Wealth Management has taken big leaps

From a relatively low base, mobile availability increased 50% in Australia.