Frollo study shows Open Banking delivers superior data quality

Frollo, Australia’s leading Open Banking provider, has published a study by Dr Zhitao Xiong, Head of Data Science, demonstrating the superior quality of Open Banking data compared to traditional screen scraping methods.

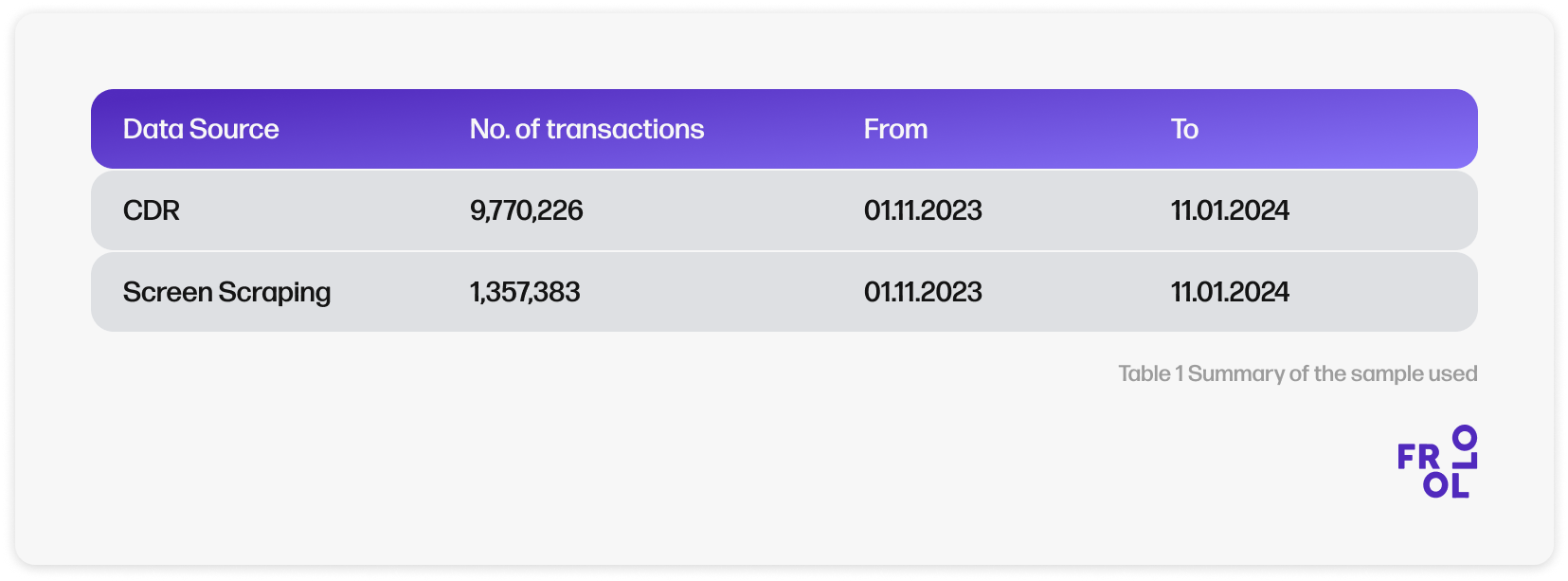

The two-month study (Between November 2023 and January 2024) analysed anonymised data from 9.7 million CDR transactions and 1.3 million screen-scraped transactions within the Frollo money management app. The results offer compelling evidence for financial institutions seeking to leverage the power of accurate and insightful financial data.

Open Banking delivers richer data and cleaner operations

“While screen scraping has been a common practice, it inherently limits the data available,” explains Dr Xiong. “Open Banking provides a standardised and secure way to access crucial details like merchant category codes and biller codes, enabling deeper financial insights.”

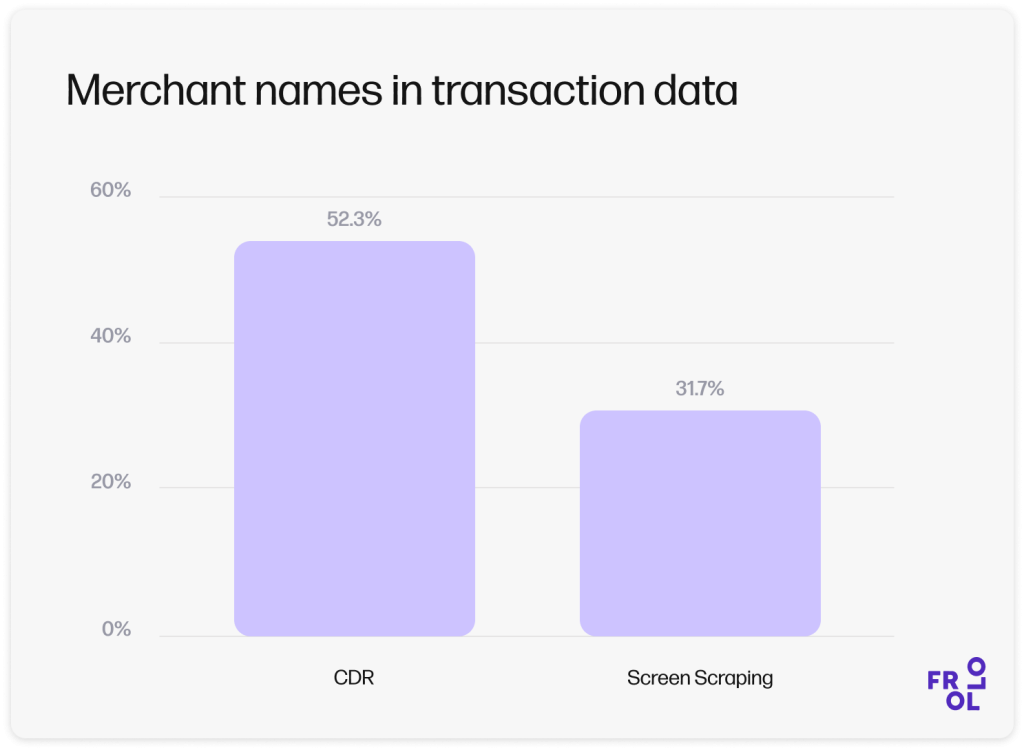

The study revealed a significant advantage in data richness with Open Banking, which provides merchant names in over 52% of transactions compared to just 31.7% for screen scraping. This translates to a more comprehensive understanding of user spending habits.

Open Banking also provides cleaner data, which is critical for the seamless operation of AI-powered financial tools. Dr Xiong highlights the importance of ‘clean data’ for advanced data enrichment engines like Frollo’s IDEaS service, which powers the transaction categorisation and insights for its Financial Passport and Money Management platform.

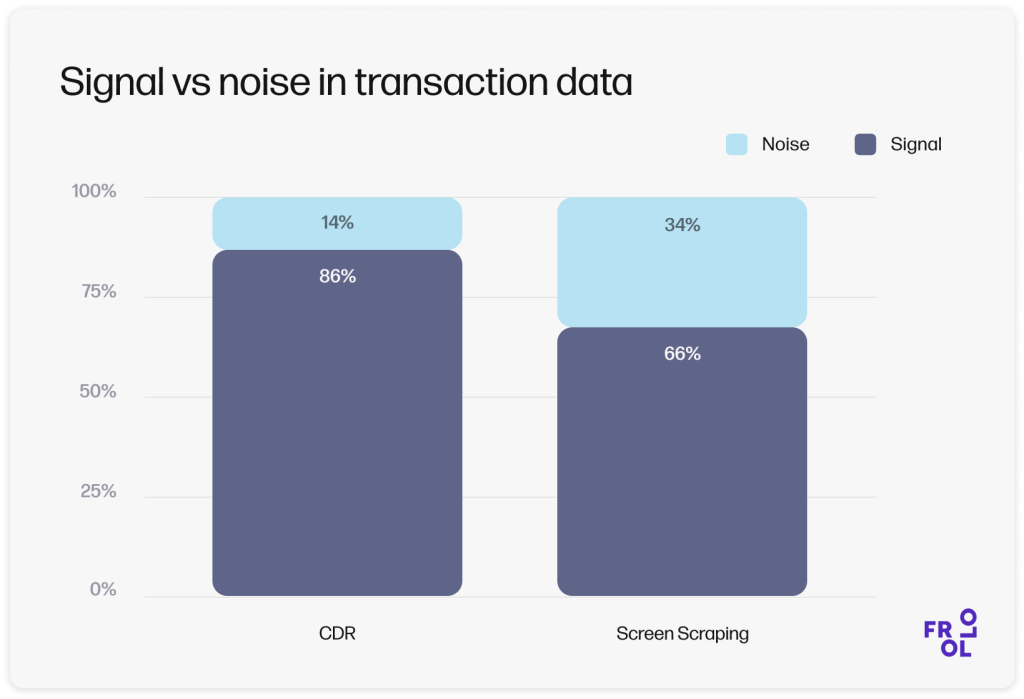

“Imagine financial data as a conversation,” said Dr Xiong. “Open Banking removes the background noise of irrelevant characters and inconsistencies, allowing AI to focus on the clear signals within the data.”

The study demonstrates a stark difference in data quality, with CDR data containing only 14% irrelevant words compared to 34% in screen-scraped data. This results in a smoother user experience, as Frollo users re-categorize screen-scraped transactions 30% more often.

The results align with previous research, where Frollo compared the transaction categorisation accuracy of its own CDR-powered Financial Passport with those of screen scraping-based competitors. That research, too, showed CDR to deliver significantly better results than screen scraping.

Open Banking: The path to financial Innovation

Frollo’s Chief Customer Officer Simon Docherty emphasises the importance of data quality, stating, “High-quality data is the cornerstone of accurate financial insights. For use cases like lending and money management, Open Banking provides the clean and comprehensive data essential for responsible credit decisions and personalised financial products. This empowers institutions to offer a superior customer experience, save time, and manage risk more effectively.”