Fintech lender Beforepay named 2023 Ethical Lender of the Year in Global Pan Finance Awards

Australian fintech Beforepay has been named 2023 Ethical Lender of the Year by Pan Finance, the London-based financial publication. The award recognises Beforepay’s commitment as a mission-driven organisation to providing working Australians with a safe and affordable alternative to navigating temporary cash-flow challenges.

“We’re honoured to receive the Pan Finance 2023 Ethical Lender of the Year Award and are proud to be recognised as a mission-driven fintech,” said Jamie Twiss, CEO of Beforepay.

Rapid growth through ethical lending practices

Beforepay and its flagship wage-advance product have grown rapidly since commercial launch in August 2020, with more than 220,000 active customers in Australia as of March 2023.

Beforepay’s risk-decisioning model uses machine learning (ML) to determine which customers to approve for advances and how to set the size of the advances. Developed by a team of data scientists, Beforepay’s ML models are trained and validated on hundreds of millions of data points, searching over 50,000 features to determine the best 500 attributes to include in the model. These attributes cover a wide range of income, expenditure, and behavioural data, and allow Beforepay to accurately identify eligible customers and ensure limits are set within customers’ means.

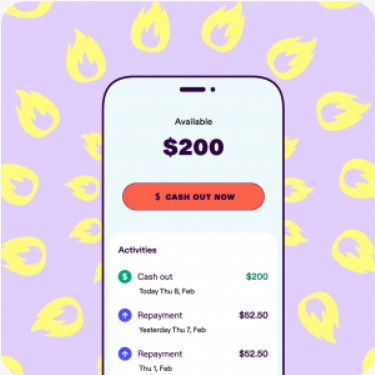

Established to disrupt payday lending and support consumers who are underserved by traditional financial institutions, Beforepay provides eligible customers with access to advances of up to $2000 for a 5% fixed transaction fee, with no interest or late fees. Customers can only take one advance at a time, with each advance needing to be fully repaid before a customer is eligible for a second one, ensuring that users do not fall into a debt spiral. Unlike banks that issue credit cards or personal loans, Beforepay’s only incentive is for the customer to repay the advance on a timely fashion.

The need for accessible financial products is clear, with the average Beforepay customer income at about $59,000 annually, very similar to the average Australian income. Beforepay fills this gap by providing a short-term lending product that is tailored to the average Australian.