Douugh becomes first micro-investing platform to integrate ChatGPT, empowering better informed financial decisions

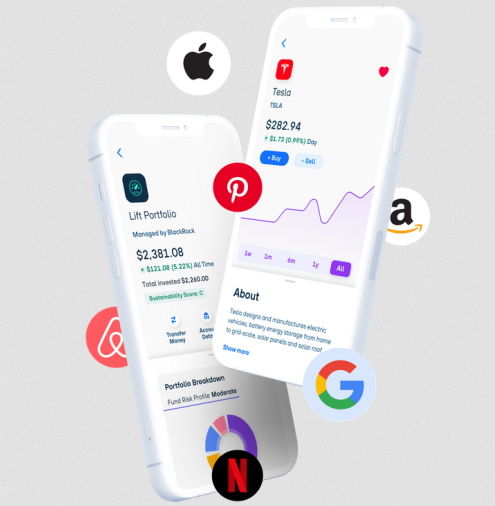

Douugh Ltd (ASX: DOU), the consumer fintech empowering Aussies to take control of their money and build long term wealth on autopilot, announces an integration with ChatGPT, an artificial intelligence chatbot developed by OpenAI.

Designed to empower customers to make more informed financial decisions and revolutionise the customer experience, Douugh users will benefit from AI-powered assistance for searches, resource discovery, education and factual information about investments on the Douugh platform.

For example, a customer can search for investments, generate comparisons, discover the differences between ETFs and shares and get the historical return for any time period for any available investment.

Andy Taylor, Founder & CEO of Douugh, says embedding AI into Douugh’s technology stack is yet another example of the company’s commitment to help Australians take control of their finances and adopt winning money habits.

“We recognise the impact ChatGPT is having on people’s daily lives in terms of accelerating human knowledge and productivity. We’re proud to utilise its advanced data services to offer a solution that helps empower users to better understand impacts and risks associated with their decisions in a simple and useful way.”

“Douugh has been at the forefront of fintech innovation for a number of years now. This is the latest example of our dedication to innovation, advanced data systems and providing the tools our customers need to meet their financial goals.”

The integration underscores Douugh’s commitment to advanced data systems, led by the Douugh Autopilot offering.

Tom Culver, Douugh’s Chief Operations and Compliance Officer, is leading the ChatGPT integration under Douugh’s Australian Financial Services (AFS) Licence and emphasises the primary goal of this integration is not to provide personal financial advice.

“To ensure the AI maintains a tool for general intelligence and search, we’ve implemented strict guardrails to limit the ‘randomness’ of the responses generated by ChatGPT and focus on providing factual information,” Culver explains.

“ChatCPT can explain complex financial terms in plain language which opens the door to democratise investing for more Australians to make more informed decisions regarding their money. However, as it is unable to account for personal circumstances or provide personal advice, we recommend always doing your due diligence and seeking advice where appropriate.”

The product has been beta tested and will be beta tested to a small number of users before becoming available to all customers in Q4 2023.

The ChatGPT integration is the first step in a series of AI-powered enhancements to the Douugh platform, setting the stage for a more dynamic and interactive user experience in the future.