DigitalX launches Drawbridge, its first RegTech product for publicly traded entities

Technology and investment Company, DigitalX announce the launch of its first RegTech product with the release of the Drawbridge application to market.

RegTech for securities dealing policies

Drawbridge addresses a need for improved administration of securities dealing policies by listed entities, which specify the compliance rules for those companies in managing insider trading risks and the orderly acquisition and disposal of securities in those companies by those within the company.

Over 10,000 change in director interest notices are lodged annually on the Australian Securities Exchange alone, with the process often prone to high profile mistakes to the detriment of shareholders, caused in part by human error or a lack of understanding of when it is appropriate or inappropriate to trade securities in the entity.

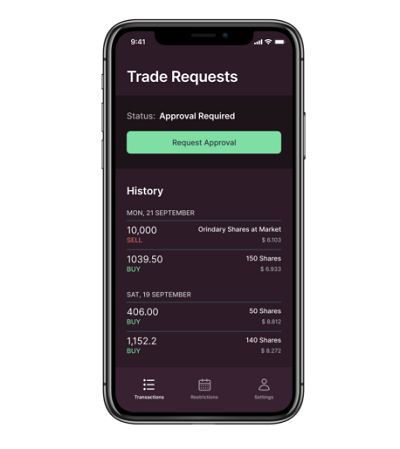

The Drawbridge application allows listed companies to digitise trading restrictions under their policy and automate necessary approvals for employee and director trading. The product’s future development will look to add additional features such as an employee share sale facility, training and education option, and real-time access to trading data for companies utilising the product.

Product launch plan & Early Adopter Programme

In addition to DigitalX having already adopted the solution for its own workforce, the Company has already launched its ‘Drawbridge Early Adopter Program’ (EAP) to bring on board initial users to provide feedback and assist the ongoing development of the version 1 product.

These early customers subscribing to the EAP will receive a discounted rate for an initial 6-month period in exchange for providing valuable feedback for additional features. Customer feedback will be used to prioritise the highest value features for inclusion in the Drawbridge product roadmap for future development. Onboarding of these EAP subscribers is expected to occur over December 2020 and January 2021.

The product launch plan is aimed at reaching corporate governance professionals of publicly listed companies. The strategy is focused on customer acquisition through a mix of channel partnerships with professional bodies and services firms, as well as direct marketing to company secretaries and compliance managers. The Company’s initial target market is the circa 2,200 companies listed on the ASX, who are all required to have a securities trading policy as part of ASX corporate governance requirements. There is opportunity to grow the Company’s target market to other global exchanges after this launch phase, although no action has presently been undertaken to promote Drawbridge to companies listed outside Australia.

DigitalX anticipates further opportunities to service this significant customer segment with additional RegTech products and services, and has become a Foundation Consulting Partner with Digital Asset Holdings in support of this1.

Leveraging DigitalX’s blockchain expertise

The Company’s Board and Management believe that blockchain technologies will be foundational to the transformation of financial markets infrastructure globally. Drawbridge is the first step in the Company’s strategy to utilise its blockchain and market experience to develop scalable products within the RegTech market.

DigitalX is positioning itself at the forefront of these developments in capturing this opportunity for shareholders. Earlier this year, as first referenced in the Company’s Quarterly Activities Report for the quarter ended 31 March 2020, the Company established a research and development program to prioritise opportunities for commercialising RegTech products and blockchain technologies with strong financial markets applications, utilising the Company’s experience in using and developing blockchain technologies. The programme included meeting with various parties involved in the regulatory ecosystem for public companies in Australia to identify common regulatory requirements that could be considered for Blockchain-based improvements, as well as considering internally how products could be designed to address those requirements.

The programme also identified the distributed ledger technology DAML as a key development opportunity for the Company to utilise as it connects the largest listed companies in Australia, Hong Kong and Singapore to a common technology infrastructure and lead to the Company undertaking the work to be included as a Foundation Consulting Partner for Digital Asset Holdings. A series of design workshops and discovery interviews have then been used to identify current challenges for financial market participants and corporate governance stakeholders that could be best solved using blockchain-based technologies. The outcome of those workshops has been the development of this first product.

DAML was developed by Digital Asset Holdings and creates a pathway for integration with global securities exchanges. Digital Asset is backed by 18 strategic investors including BNP, VMWare, J.P. Morgan, Citibank, Goldman Sachs and the ASX.

The Company has had discussions on the potential for DAML apps like Drawbridge to be run on the future ASX DLT as it comes online. The deployment of Drawbridge on the ASX DLT would be subject to entering into the relevant arrangements with ASX DLT at the relevant time.

Paul Stonham, ASX Head of DLT Solutions at ASX said, “The coming ASX DLT is designed as a common infrastructure for digital financial services, with the CHESS replacement being the ASX’s cornerstone application. RegTech apps such as Drawbridge will be able to leverage this infrastructure to offer enhanced services and new innovative solutions to issuers, exchange participants as well as a broad user group across financial services.”

DigitalX Executive Director Leigh Travers said, “Drawbridge represents the first application in our push towards providing next generation RegTech solutions into the market. While the research and development phase was extensive over the year, the pace and quality of the development is a testament to the small team and their execution capabilities. Importantly, it only marks the commencement of our work in this area and our team is already focussed on developing new products, utilising our blockchain skills and experience, to create a big presence in this space and create a new line of revenues for the Company.”

1. https://www.digitalasset.com/partners