Digital disruption of wealth management

The wealth management industry is in the process of becoming digitally disrupted by Financial Technology (fintech) on all levels. Previously, the regulatory environment had not been conducive to alternative wealth management practices, but this is changing.

A rigorous regulatory environment has been one of the reasons fintech in wealth management has been slow to establish itself. But, the Australian Securities Investment Commission (ASIC) has recognised the growing importance of the fintech sector and is proactively engaging with the sector across all areas of financial services with the establishment of the Innovation Hub. Further recent support of fintech by ASIC goes a long way to opening up financial services to new entrants.[1]

Fintech as a wealth solution is likely to be welcomed by consumers who may have become increasingly disillusioned with traditional wealth management and advice, due to high fees and underperformance.

Early fintech starters

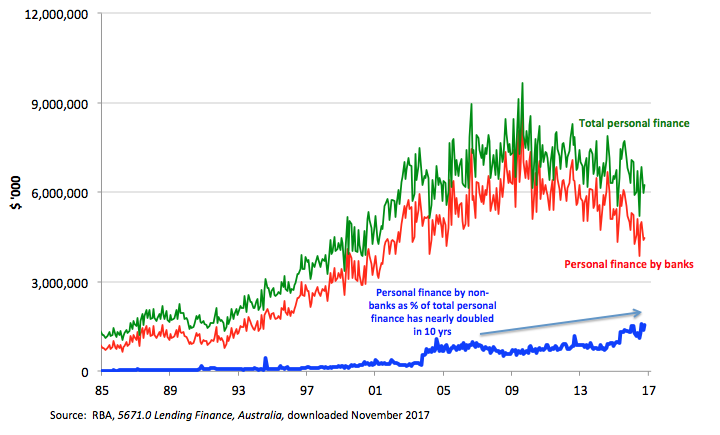

One of the initial impacts of fintech has already been felt with falling personal lending by banks (See Figure 1). Fintech lenders known as peer-to-peer (P2P) or marketplace lenders have launched numerous new market offerings in recent years. P2P lenders or marketplace lending platforms provide consumer loans to borrowers based on their credit worthiness. Investors fund the loans and receive a fixed interest-like stream of income, although credit risk may mean the risk of capital loss or distributions not being paid.

The ease and swiftness with which fintech lenders have been able to capture some of the major banks’ market share was partly driven by the incumbents dragging their feet in challenging the newcomers. Figure 1 shows that banks have seen falling personal loan finance, while non-bank lenders are seeing an increase in market share of personal loans. Marketplace lenders in total have seen growth in personal loans up 50% in 2016/17 with a total of $252 million loaned to consumers.[2]

To read more about the digital disruption, please click on the link below….

Source: Digital disruption of wealth management – DirectMoney

2. http://download.asic.gov.au/media/4573524/rep559-published-14-december-2017.pdf