Debt negotiation app Lever launches, giving Australians power over their debt

Lever, Australia’s first debt negotiation app, has launched to help the 61% of working Australians in debt get unstuck from their debt and move forward.

The fintech solution is giving people power over their debt by guiding them through self-serve debt negotiation and management. Consumers can take control and negotiate any outstanding debt or unexpected bill with any Australian company privately and securely through the legally binding app.

Financial insecurity and hardship is hiding in plain sight in Australia with 55% of Australians struggling to pay their electricity and gas bills on time, 45% struggling to pay their credit card bills and 39% their phone and internet bills. Lever founder Trent McKendrick said the app was created because debt is weighing heavily on Australians and the majority don’t realise that they can negotiate with their providers, creditors and lenders, giving them debt resolution options they don’t realise are available under credit and debt regulation.

“We know that consumers look for band-aid solutions or new lines of finance like payday or debt consolidation loans when they’re faced with the pressure that comes with an outstanding account or debt demand. But the reality of these options means they end up stuck in even more debt,” said McKendrick.

According to Lever research, 89% of Australians have not considered debt negotiation as a means of financial assistance.

“Lever has been developed to make an emotional situation more positive by giving consumers the tools and support they need to negotiate, settle and move on from their debt, without impacting their financial future by protecting their credit scores,” McKendrick continued.

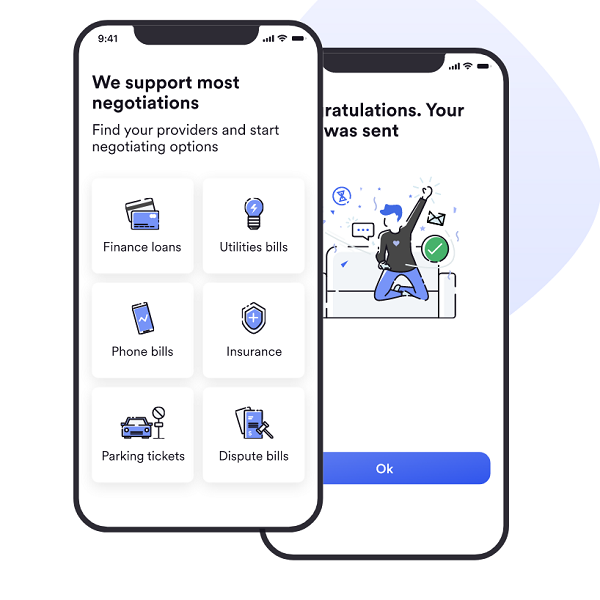

Lever allows Australians to negotiate bills and debt including parking tickets, fines, utility bills, phone bills, car finance loans, and even debt collection demands. Most Lever users manage debts ranging from $2,000 to $5,000, but some manage much larger debts.

The Lever app facilitates fast, effective and private communication for consumers to learn their debt settlement options, including reduced billing frequency, payment plans, discounted settlements and more. It incorporates suggestive ways to negotiate, as well as payment and instalment reminders, to ensure users are on top of their debt at all times.

“By bringing the debt negotiation process online, we’re making it easier for companies and creditors, too. Their outstanding accounts can be resolved without heavy-handed tactics, creating a more positive customer experience,” commented McKendrick.

Australians can settle a one-off debt through Lever for $11.99, or purchase an annual subscription allowing unlimited debt negotiations for $59.99.

Lever can be accessed online or by downloading the app from the App Store.