DASH takes managing SMSFs to the next level

DASH Technology Group has introduced significant enhancements to Archer, its goals-based advice tool for scenario modelling and real-time client engagement.

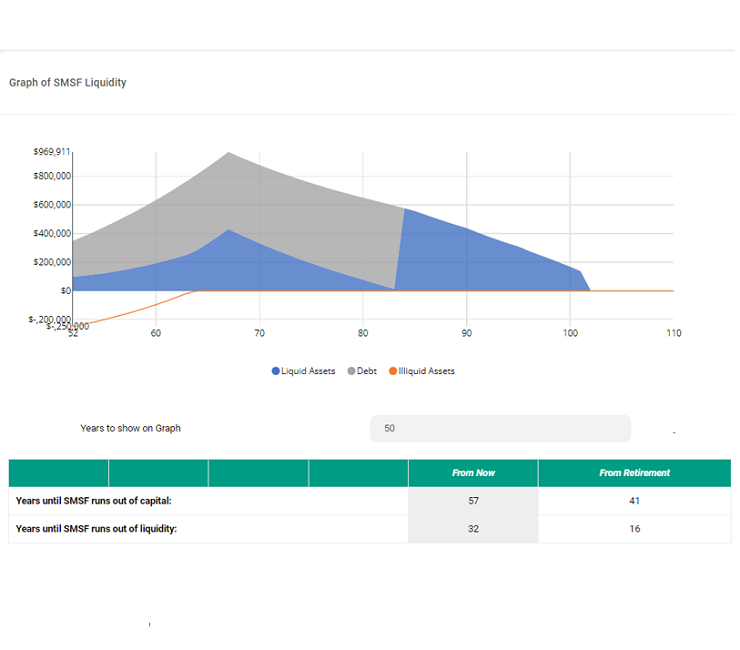

In addition to Archer’s existing capabilities, Self-Managed Super Fund (SMSF) capabilities have been enhanced. A dedicated tool has been added to help explain and evaluate a potential or existing Limited Recourse Borrowing Arrangement (LRBA). This tool will help evaluate the benefits of the LRBA, its impact on cashflow, and the point in time the SMSF is projected to run out of liquid assets over the projected period. This is a valuable resource for those considering an LRBA as part of their investment strategy.

These enhancements will also allow the optional modelling of a working account and different portfolios of assets within the SMSF, with each portfolio having its own rates of return, fees and liquidity characteristics.

Cameron O’Sullivan, Head of Product – Digital Engagement at DASH, commented, “We’re confident these enhancements will make managing your clients’ SMSFs more efficient and insightful than ever before. When you combine these new features with the existing goals-based modelling, the value-add to the client experience is ten-fold.”

“The difference with this tool is it is an optimiser, not a calculator that requires a human to determine the specific details of a strategy, like the exact dollar or pre- and post-tax contributions required for the clients, for every year of the strategy. An optimiser only needs to know how much surplus income to allocate to the retirement goal, it uses an algorithm to do the rest.”

Further, earlier this year The Value Gap report by Effortless Engagement highlighted the disparity in clients’ confidence in advisers reaching their goals, only 57% are confident that their adviser is capable of meeting their goals, while advisers are 92% confident. Resolving this issue is paramount in growing the number of Australian’s that are advised, as well as maintaining current client satisfaction.

“Tools like Archer, which can be used in front of the client to model various scenarios and goals, showing the client right then and there the value of advice,” O’Sullivan stated.

He continues, “Archer is designed to show the benefits of a particular strategy the adviser might be considering on-screen in a couple of minutes. It aims to eliminate hours of paraplanning, and to enable the adviser to deal with a lot more ‘what if’ style questions from their client on the spot, showing them the impact of such a change.”