Credit Clear continues profitable growth with new monthly revenue record, awarded “Best use of AI by a Fintech” for second consecutive year

Credit Clear has extended its consistent revenue growth with a new revenue record of $3.28 million in August. The month saw strong contributions to growth coming from large new clients onboarded in the past few months as well as growing debt referrals from existing clients. The groups legal recovery businesses also produced strong growth in revenue for the month.

Top 5 clients by revenue in August are:

- Financial services consumer lender (new client onboarded in 2022)

- A large education provider (existing client passing on more files in arrears)

- Large energy utility (new client onboarded in 2022)

- Water utility (where the client’s collection panel has reduced from 4 providers to 2)

- Large toll road operator (Seeing a recovery in traffic activity)

The success that Credit Clear has demonstrated in onboarding new clients, often as one provider on a panel of collection agencies, and then winning significant new work with these clients becoming top 5 contributors to revenue, clearly reflects the performance of the ‘digital-first’ hybrid offering and the company’s ability to manage the onboarding process through to full delivery of hybrid services.

Credit Clear’s revenue run-rate is now $39.4 million and the company has achieved four consecutive months of operational profitability.

Digital collections

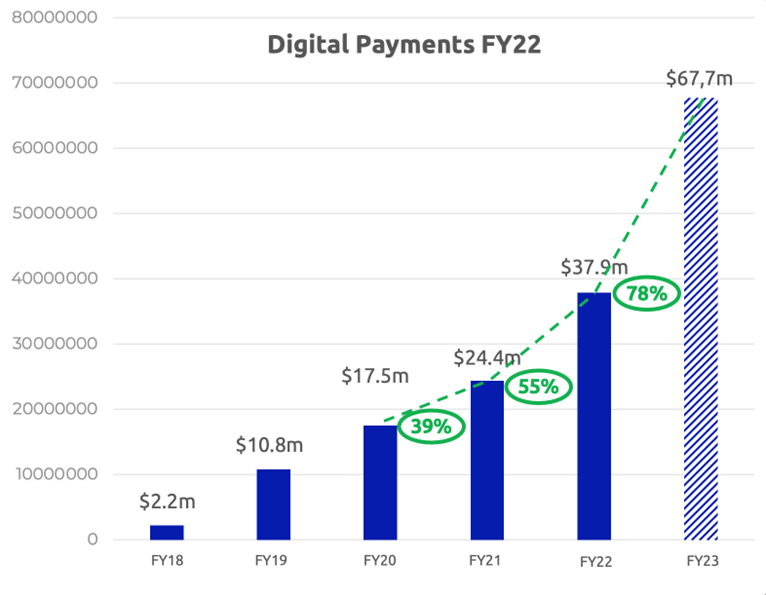

In August the company set a record for payments collected via the digital platform, surpassing $5 million collected in a month for the first time for a total of $5.64 million. August was the fourth consecutive month of record digital payments with May, June and July also posting records. The graph below shows the growth in digital payments and highlights the acceleration in the last two years. The striped FY23 column is an annualised number from the actual digital collections in August, and assuming no further growth for the year.

New Clients

Credit Clear has signed 38 new clients in August that are collectively expected to add $418,000 in revenue to the business over the next 12 months. Of note in August was a new scope of work with a finance, investment and leasing specialist.

Total expected additional annual revenue from new clients since 1 January 2022 is $10.77 million:

- January – $1.6m

- February – $1.5m

- March – $2m

- April – $2m

- May – $1.5m

- June – $580k

- July – $1.17m

- August – $418k

Pipeline

In August the pipeline of new business was strengthened considerably with multiple opportunities with blue-chip companies progressing to final and/or contract negotiation phase. These opportunities include discussions with leading insurers, commercial clients, a big four bank, consumer finance providers, government departments and utility providers.

Progress in the insurance sector has been particularly notable and the Company expects to be able to announce significant new insurance clients in the coming months.

Technology recognition

Credit Clear has been awarded the “Best Use of AI by a Fintech” at the 7th Annual Australian Fintech Awards. It was the second year running that Credit Clear collected the award and recognition of the empirically base case studies demonstrating Credit Clear advanced use of AI in the collection industry.

This year’s submission to the Australian Fintech Awards was based on Credit Clear’s AI-driven software, which delivered a 35% uplift in collections for one of the largest Australian toll road operators in May and June 2022. The case study measured two digitally optimised workflows using SMS, Email, and dialler calls, using the Credit Clear platform and the same message templates. The only differentiator between the two treatments was the use of Credit Clear AI to decide which action to take next for a particular customer, based on what had already happened to date.

At each stage of a customer’s lifecycle, Credit Clear’s AI driven software calculates the action that will have the greatest impact on the probability of a payment or an arrangement. This is driven by a wide range of factors, with the model having been trained on millions of interactions.

Examples are:

- Prior contact attempts such as type, channel message or time

- Customer engagement such as call answered, payment made

- Customer account details such as amount owing, age of referral.

Based on these factors the AI calculates the probability of success and drives the personalised customer activity plan. As a result of this case study, the client has decided to use Credit Clear’s AI as their primary method of collection for the first 6 weeks of their collection lifecycle going forward.

Credit Clear was also named as an Insurtech Start-up of the Year finalist in the 2022 Australian and New Zealand Institute of Insurance and Finance (ANZIIF) industry awards for its digital third-party insurance claims system, developed in collaboration with a large Australian insurer.

The completely digital (no human contact) third-party collection solution has shown to improve engagement and collection rates as well as significantly reduce the time to recover and improve the customer experience for the insured third-party.

Board appointment

Paul Dwyer has been appointed as a non-executive Director of the Company effective 9 September 2022. Dwyer founded PSC Insurance Group (ASX: PSI) where he serves as a non-executive Director and Deputy Chairman and brings exceptional insurance industry experience along with a proven track record in business acquisition, growth and international scaling.