Credit Clear has a strong start to 2023 as it expands into the insurance sector with IAG

Australian provider of technology solutions to the debt collections industry Credit Clear Limited (ASX:CCR) has announced that it has signed a two-year agreement with IAG, one of the largest general insurance companies in Australia and New Zealand, to deploy its purpose-built digital workflow for third-party motor insurance claims, enabling third parties to pay online.

By signing the insurer, Credit Clear increases its penetration into the Australian general insurance claims market, where the company believes its digital insurance claims workflow has the potential to become the de facto platform for third-party motor claims processing.

In addition, a state-based insurer has extended its contract with ARMA Group for two years, where ARMA provides third-party recoveries on its behalf.

Based on this expanded insurance sector business, Credit Clear expects insurance-related work to make a larger contribution to group revenue in FY23 of approximately $5.3m, up 141% on insurance revenue in FY22.

Digital insurance claims workflow

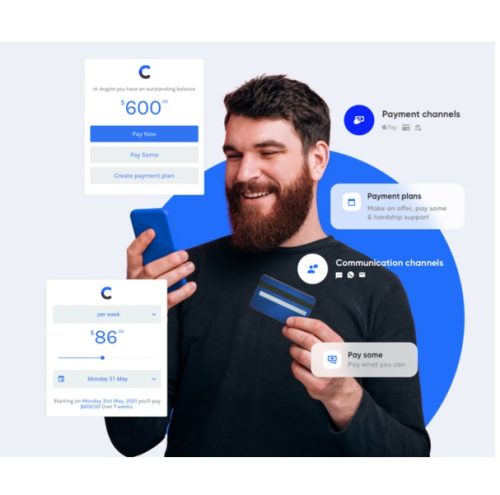

The completely digital (no human contact) insurance claim workflow has shown to improve engagement and collection rates as well as significantly reduce the time to recover and improve the customer experience for the insured third-party.

A case study conducted with a large Australian insurer has clearly demonstrated the value of Credit Clear’s digitally led hybrid approach and bespoke customisation for the insurance industry.

New clients in 2023

Credit Clear has continued its strong new business momentum into 2023 with a total of $2.4 million being signed in Expected Annual Revenue during January and February.

Credit Clear CEO, Andrew Smith, commented, “The insurance sector is a key strategic market vertical for us and we are progressively gaining traction in the Australian market, which we plan to both extend on and leverage in our future expansion plans. The digitally led offering is being well received for its potential to improve margins and collections outcomes for our customers. As we emerge from the traditionally quieter summer months in the collections industry we expect to continue to see improving sales performance across the company into the end of the Financial Year.”