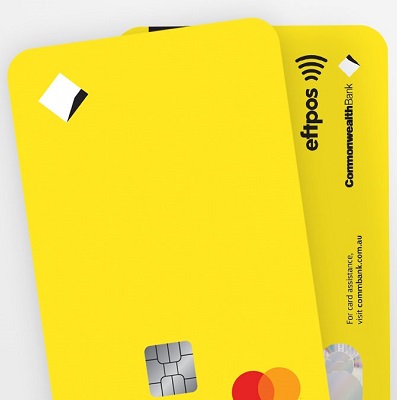

CommBank reveals its Mastercard linked buy now, pay later offering will launch mid year

Commonwealth Bank of Australia revealed plans for its own new Buy Now, Pay Later (BNPL) offering which it will begin rolling out to eligible CBA customers from mid-2021.

Available to eligible CBA customers, the new BNPL links to a CBA bank account, with no ongoing fees and at no additional cost to businesses. It is however subject to regular MasterCard and account fees, as the fine print reveals.

The CBA is an investor in Klarna, the Swedish BNPL service provider which launched in Australia last year and has more than half a million local customers already.

“Customer needs are evolving and this new BNPL offering is about giving customers more choice around how they choose to pay and when depending on the option which suits them best,” said CBA’s Group Executive, Retail Banking Services, Angus Sullivan.

“When making a payment, customers will have additional flexibility to use it for their everyday spending for smaller purchases as well as split over four instalments to help smooth payments for bigger purchases.

“Additionally we know transaction costs are important considerations for businesses. Unlike some other BNPL providers which may charge a high fee, there are no additional fees to businesses when customers choose to pay with CommBank’s BNPL,” Sullivan said.

To read more, please click on the link below…

Source: CommBank reveals its Mastercard linked buy now, pay later offering will launch mid year – Which-50