Stake unlocks $31 trillion US share market for Aussies, launching new trading app

Rapidly-growing Australian fintech startup Stake is set to revolutionise trading and open up direct access to the $31 trillion US stock market as its new trading app launches today. The app is the first to give Aussies access to more than 3,000 shares to invest in some of the world’s biggest companies with $0 brokerage, right from the palm of their hands. The app launch comes as Stake announces significant company growth. More than $50 million (US$38 million) has been transacted on the site, with more than 39,000 trades and 12,000 users who are taking advantage of low-cost, simple direct access to the US market. This next big milestone — […]

The cryptic message that has the bitcoin community buzzing

Is the unknown creator of Bitcoin writing a book about it? That could be concluded from a cryptic message posted Friday at a website possibly linked to Satoshi Nakamoto, the pseudonym used by the person or people who released the original Bitcoin white paper in 2008. The site details the “first excerpt to a literary work consisting of two parts” that promises to be “a short story if you will, with some of the most brought up questions and answers. I wanted the people and the facts to be known.” In true Nakamoto style, it even includes a cryptogram, which purports to reveal names related to the title of the […]

Airwallex in the money with $108m raise

Melbourne-based fintech start-up Airwallex has closed the second-largest fundraising round in Australian start-up history, taking in $US80 million ($108 million) for a Series B round led by Chinese conglomerate Tencent Holdings, alongside Sequoia Capital China and Melbourne’s Square Peg Capital. The company, which was founded by five Chinese-Australian 30-somethings, has built a system to enable cross-border payments by combining payments and foreign exchange transfers into a single transaction. In 2017 it raised $US19 million ($26 million) from the same investors, but it has now also added two more backers from China’s booming venture capital scene in Hillhouse Capital and Hong Kong-based Horizons Ventures, as well as Indonesia’s Central Capital Ventura. […]

Fractional investing platform DomaCom expands into rural property

ASX-listed DomaCom has taken its fractional property investing platform to the bush after tying up a partnership with rural start-up Cultivate Farms. Under the arrangement, Cultivate Farms will source appropriate properties from farmers looking to retire and match these to aspiring or next generation farmers with DomaCom providing the investment capital through its crowdfunding platform. To help get the project off the ground, AFL great and farming sector advocate Kevin Sheedy has come on board as ambassador. “The idea behind this project is to enable young farming families to get their foot on a property they can farm commercially, while at the same time enabling a retiring farmer to sell […]

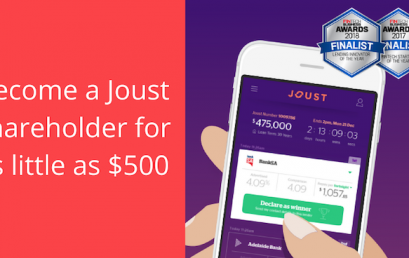

Adelaide fintech startup Joust seeking to raise $2m in Equity Crowd Funding

Adelaide fintech startup Joust is launching an equity crowdfunding campaign via OnMarket and is hoping to raise $2 million to rapidly scale the business. The Joust platform, launched in 2016, links borrowers with more than 20 lenders who compete against each other to offer the lowest interest rate via a reverse auction process. Using equity crowdfunding platform OnMarket, the company plans to spend a large portion of the money raised on advertising, with the remaining funds to go towards product development, potential entry into overseas markets and building out the Joust team. A minimum $700,000 is being sought as part of the capital raise, which allows retail investors to invest between $500 […]

Younger advisers drive digital client engagement

Financial planners are increasingly looking for digital means to engage clients, latest Investment Trends research shows. The majority (88%) of advisers are strengthening their client relationships using technology-based solutions to interact and disseminate information, this year’s Planner Technology Report found. The younger generation of planners are driving the digital client experience trend, starting with virtual client meetings. Investment Trends research director Recep Peker said this group expects tablet-enabled client meetings and the use of interactive modelling tools during client meetings to become the norm. Peker added the results provide an opportunity for platforms and planning software providers to collaborate with planners. “Technological advancement is rapidly increasing consumer expectations, a so-called […]

One of the world’s largest crypto-exchanges Huobi Global is coming to Australia

Huobi Global, one of the world’s biggest crypto-exchanges, is preparing to launch in Australia, and Adrian Harrison, chief of the local operation, says the forward-thinking regulatory landscape here puts the country at the forefront of the crypto-movement. Domiciled in Singapore, Huobi provides exchange trading for cryptocurrencies, with 150 coin pairings available. According to Harrison, the exchange is “consistently in the top three in the world, in terms of volumes”. In February, Huobi raised $US300 million ($406.7 million) through the launch of its own Huobi Token, which allows exchange users to benefit from discounts in fees. It launches in Australia on July 5, and will start by listing Australian dollars against […]

What you need to know about cryptocurrency and tax

The rapid rise of cryptocurrency means many Australians now either invest in bitcoin and other cryptocurrencies or use them as a convenient way to pay for goods and services. But what happens on the tax front when your cryptocurrency portfolio suddenly pays big digital dividends? CoinJar co-founder and CEO Asher Tan explains the key things you need to know. Cryptocurrency use has grown exponentially in the last two years and Australians have embraced cryptocurrencies as a way to spend, send and trade money from anywhere in the world. Today Australia is the world’s 11th biggest market for bitcoin volume. It comes as no surprise, therefore, that governments around the world […]