ASX-listed fintech lender Wisr delivers 54% growth in loan originations

ASX-listed Wisr Limited have provided a market update for the quarter ending 30 September 2024 (Q1FY25).

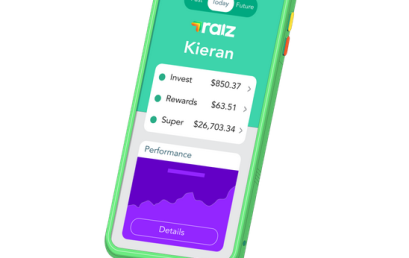

Raiz Invest announce quarterly revenue in excess of $5.6 million

ASX-listed micro-investing fintech Raiz Invest have announced its Q1 FY25 results, with quarterly revenue coming in at $5.66 million, up 15.2% year-on-year.

Change Financial announce the retirement of Alastair Wilkie as Director

ASX-listed Change Financial recently announced that following more than five years of service to Change, Alastair Wilkie will be retiring from the board.

CreditorWatch rates 16.2% of hospitality businesses as high risk or above

CreditorWatch have revealed that businesses in the hospitality sector are currently exhibiting an extremely high level of risk compared to other sectors.

BGL Corporate Solutions recognised as one of Australia’s most innovative companies

BGL have once again been recognised by the AFR BOSS Most Innovative Companies program as one of Australia’s most innovative companies.

October 31 tax deadline looms: Half of self-employed Aussies yet to file with time, cost and stress holding them back

New data from tax and accounting service Hnry reveals nearly half of self-employed Aussies have yet to file their tax return.

Plenti takes 2024 asset-backed securities issuances to over $1.1 billion

ASX-listed Plenti Group have announced the pricing of a $330 million ABS transaction,, taking total issuance for the year to $1.16 billion.

Novatti completes tranche 1 of its share placement

Novatti Group have announced the completion of tranche 1 of its share placement as part of the company’s capital raising of up to $9.4 million.