Australian Tax Agency Seeks Public Input Concerning Cryptocurrency Taxes

The Australian Taxation Office (ATO) has been researching how to formulate regulatory guidelines for taxing cryptocurrencies recently. This week the ATO is seeking input from Australian residents concerning how the country should tax digital assets. Over the past few months, the ATO has been drafting taxation guidelines for cryptocurrencies like bitcoin. The Australian tax agency has already described how it wants citizens to record all of their digital asset transactions and document the Australian dollar value amount at the time of each transaction. The ATO’s “Seeking Input” letter details its recently defined descriptions “resulted in queries from the community about how to approach specific tax events.” In order to deal […]

‘I’m not a silly investor’: SMEs accepting cryptocurrency as payment

When Robert Tadros was asked by a client last year if he would accept cryptocurrency as payment, he was “quite taken aback”. Being a believer in blockchain technology and a crypto-investor himself, the founder of search and social agency Impress!ve Digital was open to the request. “It’s an online store that the client operates. He was paying for his stock in cryptocurrency. So I embraced the idea.” Cryptocurrency client base increases In 12 months, Impress!ve, has grown 500 per cent from $600,000 to $3.5 million in annual revenue. Tadros attributes this growth to pivoting from a being a generalist agency to specialising in SEO, SEM and Facebook advertising. Three of […]

Blockchain: A catalyst for new business models

The concept of blockchain technology is all but synonymous with cryptocurrency. It’s through pioneers such as bitcoin that everyday consumers have come to recognise this revolutionary and instantaneous mechanism for executing and recording financial transactions. But in business, curiosity is turning into innovation and experimentation. The use of blockchain to complete financial transactions is one of the more rudimentary applications of this technology. Blockchain means we now have a way to handle information without relying on a single trusted ledger, such as banks in the context of cryptocurrencies. Across all industries, how we verify, audit, enter, record, and update data has been left to a patchwork of different technologies and […]

Cryptocurrencies aren’t ‘currency’, says RBA

The Reserve Bank of Australia has reiterated its attack on cryptocurrencies, questioning their purpose and pointing to the lack of demand from the finance industry. Speaking in Sydney at the ASIC Annual Forum 2018, RBA assistant governor Michele Bullock said she “object[s] to the term ‘cryptocurrency’”. “It isn’t currency. They’re not currencies. You can’t use them, typically, to make payments,” she said. “They don’t store value, and they’re not a unit of account. The name’s a misnomer to begin with.” Ms Bullock pointed out the fact that the RBA did already have electronic Australian dollars, called eAUD or ‘exchange settlement accounts’, but that this was restricted to banks needing to […]

Digital Currency market in Australia grows as trading on crypto-exchanges tops AU $3.9 Billion in 2017

Australia’s digital currency market is booming. This is according to a report by the Australian Digital Commerce Association (ADCA) and Accenture that tallied the numbers for 2017. During the year, over AU $3.9 billion was traded on cryptocurrency exchanges with more than 300,000 active traders. Unsurprisingly, Accenture / ADCA said the majority of traders were under the age of 40. Even more telling is the information that 40 percent of cryptocurrency customers are aged 18 to 29. The most popular digital currency was Bitcoin with AU$1.86 in volume followed by Ethereum with AU $712 million in trading. The research also revealed that crypto is creating jobs. Employment across the cryptocurrency […]

Twitter CEO: Bitcoin will be the world’s ‘single currency’ in 10 years

Twitter and Square CEO Jack Dorsey apparently has big visions for bitcoin, commenting in a recent interview with The Times that he believes that the cryptocurrency will become the world’s single currency within 10 years. According to Dorsey, “The world ultimately will have a single currency, the internet will have a single currency. I personally believe that it will be bitcoin.” Dorsey went on to say that the transition would happen “probably over ten years, but it could go faster,” which seems like an extremely unrealistic projection, even considering cryptocurrency’s meteoric rise in popularity over the past few months. That Dorsey is a fan of bitcoin isn’t too surprising, though. […]

How crypto currently looks in Australia

Australian crypto investors are like any others: long-term investors, short-term traders, and true believers who want currency beyond control of central banks. WHY ARE AUSTRALIANS BUYING CRYPTOCURRENCIES? Some are long-term investors, others are short-term traders, and some are true believers who want currency to be beyond the control of governments and central banks. All are hoping the value of Bitcoin (or their chosen asset) will appreciate over time as they become more readily accepted. WHY DO AUSTRALIANS NEED USE AUSTRALIAN EXCHANGES? Most people buy their first Bitcoin, Ethereum or other cryptocurrency using their day-to-day currency. If you hold Australian dollars and want to buy your first cryptocurrency, you need to […]

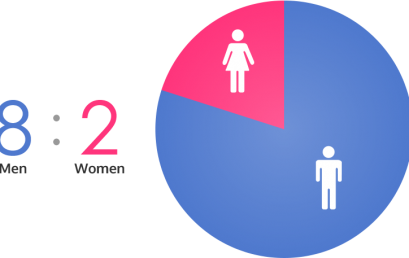

8 out of 10 Aussie Bitcoin traders are men

Eight out of 10 people trading cryptocurrencies in Australia are men, according to joint research by the Australian Digital Commerce Association and Accenture. Eighty-three per cent of the 312,633 customers registered across seven Australian exchanges at the end of 2017 were male, according to joint research by the Australian Digital Commerce Association and Accenture. The exchanges processed more than 2.7 million transactions in 2017 worth a total $A3.9 billion, at an average of $A1,430 per trade. Source: 8 out of 10 Aussie Bitcoin traders are men – SBS News