Nium partners with Visa to offer card issuance in Australia

Nium, a global financial technology platform, has become a Visa issuer in Australia as part of its membership in Visa’s Fintech Fast Track programme.

Neobank Volt has had its public launch and IPO scuttled by Australia’s shutdown, but CEO Steve Weston says the future is ‘far brighter’ because of it

Volt had been readying itself to the public, looking to close a major offshore funding round and launch itself on the sharemarket all in the same 12 months.

NPP, BPAY and eftpos merger advances to study phase

Australia’s three payments infrastructure providers look set to be merged to benefit from a single industry-wide payments platform.

Backbase and Mambu partner to deliver an end-to-end integrated SaaS banking solution

Backbase has announced a strategic partnership with Mambu to jointly deliver a unique and powerful turn-key digital banking solution.

Afterpay says no to credit checks, warns of big bank dominance

Afterpay has told a Senate Committee on fintech regulation that credit checks were irrelevant to its younger customer base.

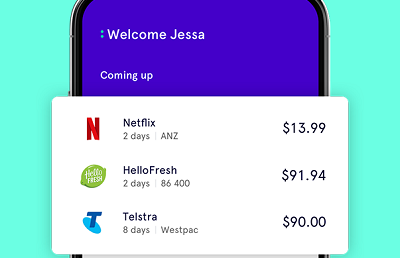

86 400 picking up thousands of customer bills in latest campaign

Smartbank 86 400 has launched a new 16-week campaign to give back to its early customers by paying over 100 upcoming bills at random each week.

Fintech companies winning big in banking and finance – here’s why

New fintech contenders are set to offer new-age banking services that capitalize on “data-fueled, hyper-personalized experiences in real-time.”

ACCC launches Consumer Data Right platform

The ACCC launches the Consumer Data Right Register and Accreditation Application Platform to allow banks and fintechs to become accredited data recipients.