Frollo hits 1,000,000 CDR (Open Banking) API calls

1,000,000 CDR (Open Banking) API calls. It’s a big milestone, not just for Australian fintech company Frollo, but for Australian consumer finance.

ME Bank launches Google Pay as demand for digital payments increases

ME has introduced Google Pay today as its customers increasingly switch to contactless and digital payments.

Digital lender introduces tiered variable rates

Neobank 86 400 has introduced tiered variable rates for borrowers, enabling customers with higher deposits to access cheaper rates.

Frollo publishes a simple overview of all product data APIs in Australia

Frollo are very excited about the Consumer Data Right and there are two types of data are available through open banking: Product data and transaction data.

Xinja Bank appoints SISS Data Services for Open Banking solution

SISS’s experience in helping connect Australia’s major banks, has enabled them to develop a simple, secure and effective API open banking solution.

Open banking to usher new wave of products

The open banking regime could enable banks to create data-driven products and services instead of the riskier mortgage offering.

Smartphone payments soar as digital wallets gain traction

Figures from banks show the use of digital wallets – smartphone payments or wearable devices that can make payments – is soaring.

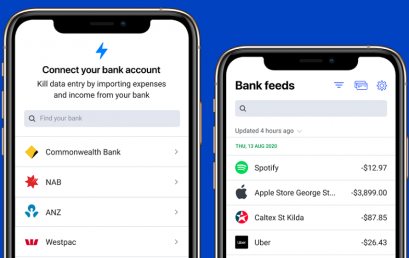

Going solo with banking data

Access to banking data via partnering with Basiq will also allow Rounded to add features such as automatic reconciliation in the near future.