Australia in driving seat as global blockchain standards take shape

Westpac director Craig Dunn will tell China this week that more engagement from its technology leaders will help the global standards-setting process for blockchain, which Australia is leading, to create guidelines that will reduce the cost of deploying the emerging technology across the global economy. An Austrade trade delegation arrived in China over the weekend ahead of this week’s Wangxiang Global Blockchain Summit in Shanghai. Australia is chairing the International Standards Organisation (ISO) group developing standards for blockchain and distributed ledgers and Mr Dunn is chairing the work. He told The Australian Financial Review ahead of a keynote address at the summit that “if you are going to have an […]

5th Annual FinTech Summit 2018: The Year of The Challenger and Neo-Banks!

5th Annual FinTech Summit 2018 – This is the Year of The Challenger and Neo-Banks! This year will see the launch of a number of ‘challenger’ and ‘neo-banks’ in Australia who will take on the Big End of Town. Remember – banks think they own the financial services sector because they have the customers and the distribution – the branch networks, and the (thousands of) financial advisors. Here’s the problem – all the new customers, the millennials, don’t trust the banks, or their advisors, and we haven’t yet heard the final recommendations of the Hayne Royal Commission – will there be criminal prosecutions? (Free Tip: It’s very hard to own […]

Irish fintech Priviti launches in Sydney as Australia prepares for Open Banking and the Consumer Data Right

As Australia prepares for its new Open Banking standards and the Consumer Data Right, Priviti, the global fintech company, is helping banks get ready to comply with new legislation and empower consumers with greater control over how their personal data is shared. Its extensive experience with global data protection laws such as PSD2 and GDPR means Priviti has seen the paradigm shift in the way financial organisations and individuals view their data, and how their systems need to change, explains Dermot McCann, Priviti’s Head of APAC. “Every day a bank is potentially engaging in new activities that could impair their compliance, particularly now in this new era of Australian Open […]

NAB Ventures secures another $50 million to invest in fintech startups: Here’s what the fund is looking for

Australian big-four bank NAB has allocated another $50 million to its corporate venture capital fund NAB Ventures, doubling the funds available to bring the total to $100 million. The fund was launched in 2016 with an initial $50 million to invest over three years. It has backed 12 businesses to date, including property investment startup BrickX, real estate communications platform ActivePipe, and data sharing startup Data Republic. It has also made investments overseas into startups in San Francisco and Toronto. NAB Ventures general partner Melissa Widner tells StartupSmart the doubling up of the funds represents an endorsement of the program from the bank. “The board liked the innovation it was […]

Top reward credit cards for Apple, Samsung, Google, Fitbit, Garmin Pay

Whether you’re an Apple or Android smartphone user or prefer Apple, Fitbit or Garmin smartwatches, chances are you already have access to Apple Pay, Samsung Pay, Google Pay, Fitbit Pay and/or Garmin Pay – all of which can be your ticket to earning valuable frequent flyer points with just one tap. For example, you might have an iPhone – compatible with Apple Pay – and can use that to pay for purchases in-store and online using your points-earning credit card. At the same time, a Fitbit Ionic or Versa smartwatch – both of which work with Fitbit Pay – might come in handy for making small purchases after your workout, […]

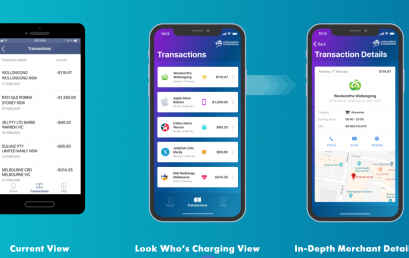

Local FinTech Look Who’s Charging eyes offshore expansion

Local FinTech start-up Look Who’s Charging has been selected as one of only 24 companies from around the globe to present their business on the centre stage at Money 2020 in Las Vegas this coming October. Look Who’s Charging is a Data as a Service business and one of the first companies globally to solve the problem of unrecognisable transactions. Look Who’s Charging links the often-random narratives from debit and credit card transactions to in-depth merchant details. NAB integrated Look Who’s Charging into their digital applications earlier this year. In the past 12 months Look Who’s Charging has helped to de-mystify over 15 million transactions many of which would have […]

Business-only bank Tyro in deal with China’s Alipay

Australian business-only bank Tyro has entered into an agreement with the world’s largest online payment platform, Alipay, to become the first Australian bank to offer an all-in-one Eftpos solution with the Chinese outfit. The partnership, which will be live from the second quarter of 2019, is designed to improve Australian business access to the Chinese visitor market. “Based on requests from several of our merchants to accept Alipay, Tyro and Alipay entered discussions to explore the best way we could work together,” Tyro CEO Robbie Cooke told The Australian. “With Tyro’s in-house engineering team, we were able to deliver Alipay in an agile way which allows for rapid market delivery.” […]

Is the future of banking Fintech or Techfin?

The banking industry is experiencing disruption at an increasing pace. Over the past few years, traditional financial institutions and non-traditional fintech firms have begun to understand that collaboration may be the best path to long-term growth. At the same time, big tech firms are offering financial services, creating techfin solutions. The rationale for collaboration is the ability to bring strengths of both banks and fintech firms together to create an stronger entity than either unit could bring on their own. For most fintech organizations, the primary advantages are an innovation mindset, agility (speed to adjust), consumer-centric perspective, and an infrastructure built for digital. These are advantages that most legacy financial […]