Calastone study shows Covid-19 continues to fuel investor appetite and engagement

A new white paper from global trading network for managed funds, Calastone, shows a clear increase in the willingness of existing investors to invest further, with Covid-19 being a stimulus.

The paper builds on a series of global surveys conducted by Calastone before and throughout the pandemic to show sentiment and behavioural changes gleaned from investors representing multi-generations and regions.

Overall, comparison of the 2021 and 2020 results reveals a marked increase in investment appetite and activity, as a direct result of Covid-19, across the board. A good deal of this shift in investor behaviour reflects a mix of pent-up demand, growing confidence in the economic outlook and an increased appreciation of financial security, says Calastone. Generation X and Baby boomers are leading the current charge, mostly in the United States, but closely followed by investors in Australia and New Zealand, noting that the poll was conducted before Sydney lockdowns started.

The paper looks at the opportunities these behaviours, some potentially accelerated by Covid, present for the global funds management industry.

KEY GLOBAL SURVEY FINDINGS:

One third of global investors are more likely to invest because of the current global Covid-19 situation

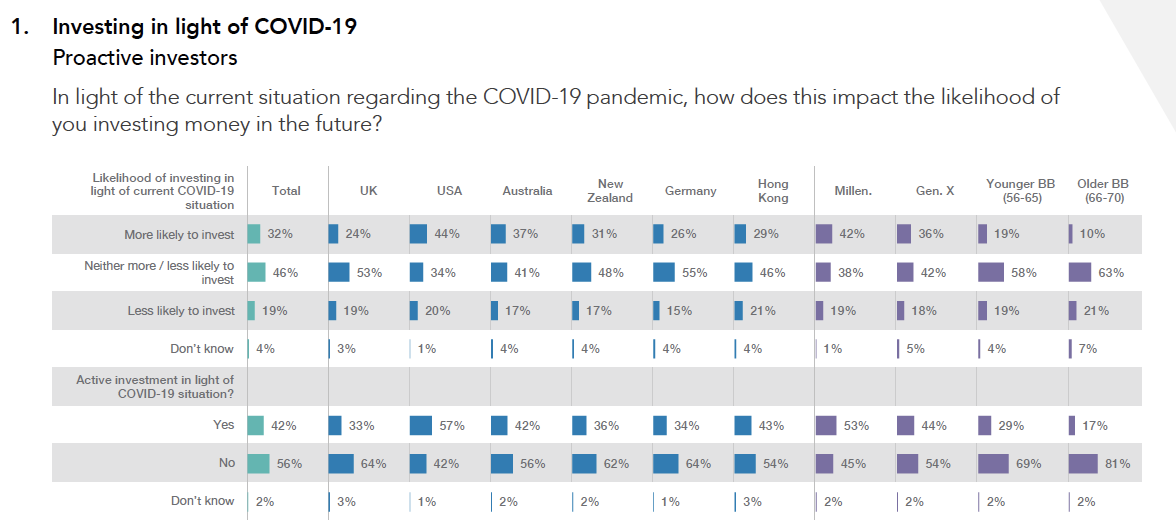

32 percent of participants surveyed from the UK, US, Australia, New Zealand, Hong Kong and Germany are more likely to invest in light of the current Covid-19 situation, and 42 percent have already done so as a direct consequence of the virus, (Fig 1).

Global Generation X investors far more proactive

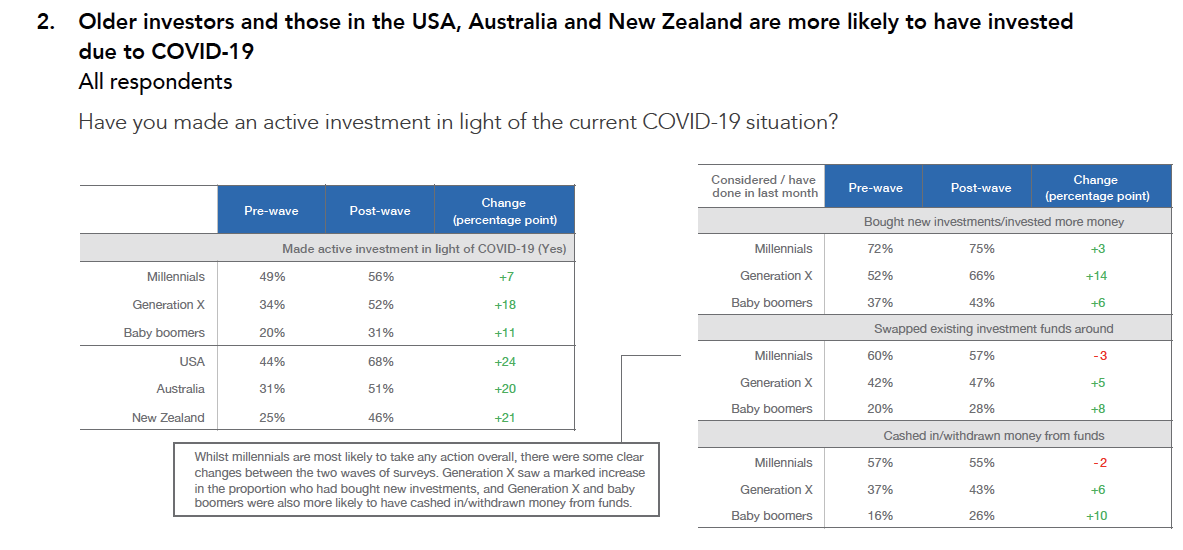

While Millennials, across the globe, have been the generation to show most investment enthusiasm and activity over the course of Covid, with 75 per cent having invested recently or are likely to invest soon, the biggest moves throughout the pandemic have been from older investors, (Fig 2 right).

More than half of Generation X investors globally (52 percent) have made an investment in light of Covid-19, a rise of 18 percent since the second wave of Covid-19 swept though most parts of the world. Baby boomers followed, showing an 11 percent rise in active investment in light of Covid. The lift for millennials was less pronounced at seven percent, (Fig 2 left).

Millennials have been the most active when it comes to swapping investment funds around or cashing in investments, though notably less so than in earlier waves, (Fig 2 right).

US, Australian and New Zealand investors most active following second global wave

Investors in the United States have showed the most conviction, with 68 percent actively investing in light of Covid-19, up 24 percentage points from pre-wave levels. Investors in Australia and New Zealand followed, with 51 and 46 percent actively investing as a direct consequence of Covid, respectively rising 21 and 20 percentage points, (Fig 2 left).

Anxiety about the future down slightly for Australians and New Zealanders

Levels of anxiety have abated for Australian and New Zealand investors, though are still high. 66 percent of Australians and 62 percent of New Zealanders said Covid-19 has made them more worried about their financial future (Fig 6), down respectively from 72 and 64 percent in 2020.

Investing knowledge and ease rising, but much room for improvement

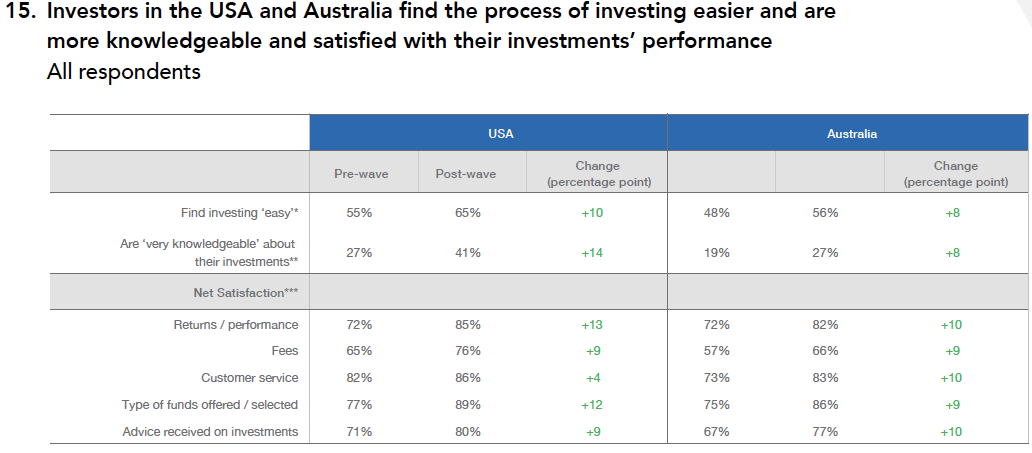

56 percent of Australian respondents found investing ‘easy’ (Fig 15 right), up 8 percentage points from 2020. There was also a marked improvement in investor knowledge, albeit from a considerably low base, up 8 percentage points to 27 percent post second global wave. In comparison, ease of investing in the US jumped 10 percentage points, to 65 percent, along with a 14 percent lift in investor knowledge about their investments, (Fig 15 left).

Investors prefer managing investments via web, remain open to non-financial providers

Australian and New Zealand investors agree with global peers that websites are the most preferred means of investing, although apps and email are growing in favour.

Incumbent providers of financial services continue to face challenges from non-traditional competitors. 47 percent of all respondents entertain the idea of buying investment products from a big technology brand, up 3% from 2020. This reflects a slightly positive shift among Australian investors, notably more pronounced in New Zealand where the response was up four percentage points.

Ross Fox (pictured), Managing Director, Head of Australia and New Zealand at Calastone, said, “Calastone’s research shows that COVID-19 and its implications for people and markets have continued to be a tailwind for investment in managed funds.

“Investors adopting a more proactive and opportunistic approach is also evident in the flow of funds that we continue to see across our network, with A$10.2 billion flowing into Australian based managed funds this year.

“This latest pulse check shows that investors have overcome some of the anxiety they expressed in earlier surveys, particularly in Australia, which perhaps signals a growing acceptance of living with Covid.

“It is possible that the mass shift to remote working environments has instilled greater familiarity and confidence with digital platforms among older generations, bringing them more in line with the behaviours of more technology trusting Millennials.

“While Australia currently feels the weight of Covid while other parts of the world appear to be recovering from the pandemic, rising levels of local engagement, ease of investing and product knowledge is a testament to the efforts of fund managers and distributors who have kept investors well informed and engaged throughout the last 18 months”, he concluded.