Butn continued strong trading with record monthly originations and revenue in November 2022

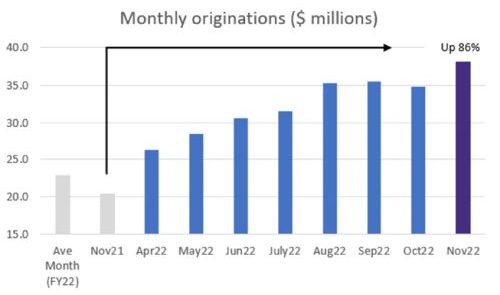

- Record monthly originations of $38 million in November 2022, up 86% on the previous corresponding period (pcp)

- Record revenue of $1 million in November 2022, up 141% on pcp

- Revenue margin of 2.6%, up on FY22’s revenue margin of 2.0%

- Butn platform originations reached a monthly record of $10 million in November 2022, contributing over 25% of total monthly originations

Trading update

Butn Limited (ASX: BTN; Butn) has delivered another record month of originations in November 2022 of $38 million, up 86% on pcp. This latest record means the Company has delivered record performances across 7 of the past 8 months.

November 2022 revenue totalled $1 million, up 141% on pcp and a record for the company.

Importantly, November 2022’s revenue margin was approximately 2.6%, up from 2.0% in FY22, reflecting an improvement in industry mix to higher-margin segments, an increased contribution of higher-margin platform originations and pass through of some pricing adjustments.

Butn’s November 2022 platform originations reached a record $10 million, approximately 8 times more than the pcp, now contributing over 25% of total monthly originations.

The accelerating record growth, delivered with stable operational staff combined with tight cost control, produced another positive EBITDA monthly result in November.

Butn’s Co-founder and Co-CEO, Rael Ross said, “The continued strong FY23 performance including record originations, improving revenue margins and tight cost control are all positive as we continue to grow. The Butn platform continues to grow its share of originations and revenue as we scale our solution with key partners through our mass distribution strategy.

“While the current macroeconomic environment presents SMEs with a number of challenges, we believe that the need for our integrated, simple, and accessible funding will continue to increase as our solution becomes more relevant to our partners and their business customers.”