The cryptic message that has the bitcoin community buzzing

Is the unknown creator of Bitcoin writing a book about it? That could be concluded from a cryptic message posted Friday at a website possibly linked to Satoshi Nakamoto, the pseudonym used by the person or people who released the original Bitcoin white paper in 2008. The site details the “first excerpt to a literary work consisting of two parts” that promises to be “a short story if you will, with some of the most brought up questions and answers. I wanted the people and the facts to be known.” In true Nakamoto style, it even includes a cryptogram, which purports to reveal names related to the title of the […]

Airwallex in the money with $108m raise

Melbourne-based fintech start-up Airwallex has closed the second-largest fundraising round in Australian start-up history, taking in $US80 million ($108 million) for a Series B round led by Chinese conglomerate Tencent Holdings, alongside Sequoia Capital China and Melbourne’s Square Peg Capital. The company, which was founded by five Chinese-Australian 30-somethings, has built a system to enable cross-border payments by combining payments and foreign exchange transfers into a single transaction. In 2017 it raised $US19 million ($26 million) from the same investors, but it has now also added two more backers from China’s booming venture capital scene in Hillhouse Capital and Hong Kong-based Horizons Ventures, as well as Indonesia’s Central Capital Ventura. […]

CXi sets course for scale up

CXi Software has ended the financial year with a strong quarter of activity, as it moves from a “start up” to a “scale up” business model. The company made a number of new senior management appointments in March and April – which preceded a move to new (and larger) premises on Queen Street in Melbourne’s CBD. The company also completed a Series A capital raising over the same period. New staff Adam Gernon was recently appointed as Chief Technology Officer, joining CXi from CenITex, where he was General Manager, Innovation and Delivery. Prior to CenITex, Adam had over 10 years’ experience in financial services technology at organisations such as NAB, […]

DIY smart contracts and customisable crypto derivatives on demand

If everything’s going on the blockchain, the blockchain needs a derivatives market. Blockchain development is tough. Unlike other systems, someone who wants to build an entire platform of their own has to get their heads around the multi-faceted nature of decentralisation, and balancing technical foundations and economic theory. Even building on an existing platform is tough work and experienced blockchain developers can now pull seven figure signing bonuses from prominent companies. Ethereum in particular poses a unique challenge. Thanks to the complexities of its own unique Solidity programming language, thousands of Ethereum contracts end up being flawed or even outright broken when they go live. Projects around the cryptosphere are […]

London fintech delegation reveals deeper Australia-UK tech links

Ten Australian fintech start-ups are in London this week on a trade delegation arranged by the Australian British Chamber of Commerce, a sign of deepening ties between the two nation’s technology scenes. While England’s game against Columbia in the World Cup and the tennis at Wimbledon offer potential distractions, so excited is the chamber about its official program it has coined a new acronym for it: The “ABFCC”, or “Australian British FinTech Cyber Catalyst”. The start-ups in the group are Everproof, Trade Ledger, TRAction FinTech, Adviser Ratings, InDebted, CYDARM Technologies, HyperIntel, Airlock Digital, Aleron and Randtronics. There’s a regtech and cybersecurity flavour, and the group is being led by Law […]

Australian FinTech company PokitPal and Booking.com sign global agreement

Australian FinTech company PokitPal, and Booking.com, the world leader in booking accommodation online, have signed a global agreement which gives PokitPal consumers cash back when they complete a transaction with Booking.com to further engage with the millennial and mobile-first markets. The new global agreement means PokitPal users can receive five per cent cash back on more than 28 million accommodation listings as well as flights, car rentals and airport transfers in 228 countries. Users simply need to book via the PokitPal App to receive the cash back reward. PokitPal CEO Gary Cobain said offering cash back to a PokitPal user’s bank card simply by using their app is a new […]

Fractional investing platform DomaCom expands into rural property

ASX-listed DomaCom has taken its fractional property investing platform to the bush after tying up a partnership with rural start-up Cultivate Farms. Under the arrangement, Cultivate Farms will source appropriate properties from farmers looking to retire and match these to aspiring or next generation farmers with DomaCom providing the investment capital through its crowdfunding platform. To help get the project off the ground, AFL great and farming sector advocate Kevin Sheedy has come on board as ambassador. “The idea behind this project is to enable young farming families to get their foot on a property they can farm commercially, while at the same time enabling a retiring farmer to sell […]

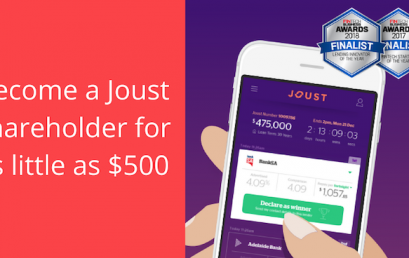

Adelaide fintech startup Joust seeking to raise $2m in Equity Crowd Funding

Adelaide fintech startup Joust is launching an equity crowdfunding campaign via OnMarket and is hoping to raise $2 million to rapidly scale the business. The Joust platform, launched in 2016, links borrowers with more than 20 lenders who compete against each other to offer the lowest interest rate via a reverse auction process. Using equity crowdfunding platform OnMarket, the company plans to spend a large portion of the money raised on advertising, with the remaining funds to go towards product development, potential entry into overseas markets and building out the Joust team. A minimum $700,000 is being sought as part of the capital raise, which allows retail investors to invest between $500 […]