Fintech enters the dictionary

Finally, after decades of usage, the word fintech has made its way into the Merriam-Webster dictionary. The portmanteau of financial technology was one of 840 new entries recently added to the online dictionary. Merriam-Webster defines fintech as “products and companies that employ newly developed digital and online technologies in the banking and financial services industries”. The word is far from new: the dictionary pinpoints its first known use to 1971, while it has been gracing the pages of Finextra since the early 2000s. However, in recent years the term has taken off thanks to a burgeoning fintech scene in places such as Silicon Valley and London and the rise of […]

Raising the bar for SME lending

For those who work in the finance industry, there appears to be no shortage of lenders and loans in the marketplace. However, for those running Australia’s 2.1 million small and medium-sized enterprises, it can be difficult to see the wood for the trees. With the intention of addressing this, in July six fintechs signed the Code of Lending Practice, a document designed to bring transparency and clarity to the online balance sheet lending space. An initiative of the Australian Small Business and Family Enterprise Ombudsman (ASBFEO) and FinTech Australia, key elements include the introduction of a pricing comparison tool allowing customers to compare the cost of unsecured loans from the signatories; […]

A mystery $1 billion Bitcoin Whale is active – What could it mean to prices?

A mystery bitcoin whale wallet holding nearly $1 billion worth of bitcoin is suddenly active after lying dormant for more than four years, according to a recent post on Reddit. Does this mean the whale is intending to dump a huge amount of BTC in the market? If you trade crypto you will hear the term “whale” and as the name suggests it is used to describe huge cryptocurrency holders. Bitcoin wallets holding around $1 billion are usually referred to as whales. With the recent activity many investors are questioning whether a dump is on its way. Some of the transactions are being traced back to a wallet address that […]

Prospa becomes first online small business lender to complete review of loan terms with ASIC

Prospa is the first online small business lender to have undertaken a full review of its loan terms after consultation with ASIC. Prospa has agreed to certain recommendations from ASIC in relation to removing or amending some of its contract terms. Some of these terms have, historically, not been relied upon, and other terms were amended to clarify or reflect existing policies. Prospa notes that the amendments agreed with ASIC do not have any material impact on the company financially or operationally. Prospa’s COO Ben Lamb said: “We’re always looking for ways to improve finance outcomes for small business owners. As the first non-bank lender to complete its review, we […]

Singapore crypto exchange KuCoin set to expand after $3m Bitcoin Australia deal

One of the world’s largest cryptocurrency exchanges, KuCoin, has invested in local exchange Bitcoin Australia and formed a new joint venture which will see the Singaporean exchange expand locally. The company has invested almost $3 million into Bitcoin Australia, which intends to use the funding to embark on its own aggressive international expansion, as well as to help KuCoin enter the local market. It has previously raised capital from Dominet Venture Partners. Bitcoin Australia chief executive Rupert Hackett told The Australian Financial Review the businesses had clear synergies, with KuCoin targeting sophisticated investors, while Bitcoin Australia aimed to make cryptocurrency trading possible for the mass market. Despite Bitcoin and other […]

Stone & Chalk: The Marketplace for FinTechs Breaking the Mould

Fintech has continued to be one of the dominant focus areas for innovation globally in 2018 and has well and truly established itself as the fastest growing sector in the financial services industry worldwide. As bold new solutions spring up from startups, the industry has seen a massive shift in shaking up the way traditional financial services operate forever. In 2015, Stone & Chalk was born to support the growth of the highest quality fintech startups across Australia. It now has two main innovation hubs in Sydney and Melbourne. Today, Stone & Chalk is home to Australasia’s leading independent fintech hub for startups, scaleups, industry associations and investors. Through Stone […]

Australian Fintech companies do it again in this year’s Anthill Magazine Smart100 2018

Once again the Australian Fintech industry has been well represented in this year’s Anthill Magazine Smart100 2018. Congratulations to the all the Australian Fintech companies who made the Smart100 list for 2018: Trade Ledger Practice Ignition eBroker Link4 For the full list of Anthill Magazine Smart100 2018 winners, please check them out here.

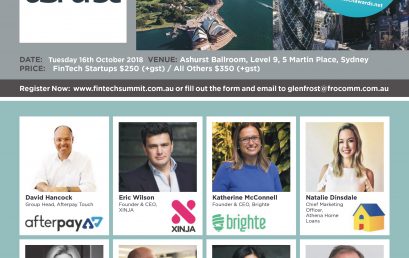

5th Annual FinTech Summit 2018: The Year of The Challenger and Neo-Banks!

5th Annual FinTech Summit 2018 – This is the Year of The Challenger and Neo-Banks! This year will see the launch of a number of ‘challenger’ and ‘neo-banks’ in Australia who will take on the Big End of Town. Remember – banks think they own the financial services sector because they have the customers and the distribution – the branch networks, and the (thousands of) financial advisors. Here’s the problem – all the new customers, the millennials, don’t trust the banks, or their advisors, and we haven’t yet heard the final recommendations of the Hayne Royal Commission – will there be criminal prosecutions? (Free Tip: It’s very hard to own […]