Basiq: Four new use cases for Open Banking’s Future

Basiq, an Accredited Data Recipient under the CDR, has published a white paper detailing the future of Open Banking in four novel use cases.

The current implementation of the CDR across the financial services industry – or Open Banking – has facilitated a fundamental shift in the way consumers interact with their data. Not only are businesses beginning to conform to Open Banking rails, but regulatory bodies are hoping that Open Banking will yield economy-wide benefits. (The Federal Government committed $111m committed to CDR in the recent Federal Budget in the hope of fast-tracking these benefits).

By February 1, 2022, the date that ‘full data transfer for consumers’ will be available, the Open Banking rubber will really start to hit the road in Australia, following large transformation programs by Banks and major strategic shifts within Financial Technology companies.

Australia is on the cusp of a seismic shift in innovation and there are a plethora of innovative use cases that will be able to leverage the CDR consent framework and Open Banking data made available. This will mean consumers have a lot more options, in no small part because of the inevitable unbundling of a large number of products currently provided by the Big Four.

This is undoubtedly the most exciting part of the Open Banking journey.

To help surface the untapped potential of Open Banking, the paper takes a deep-dive into the following:

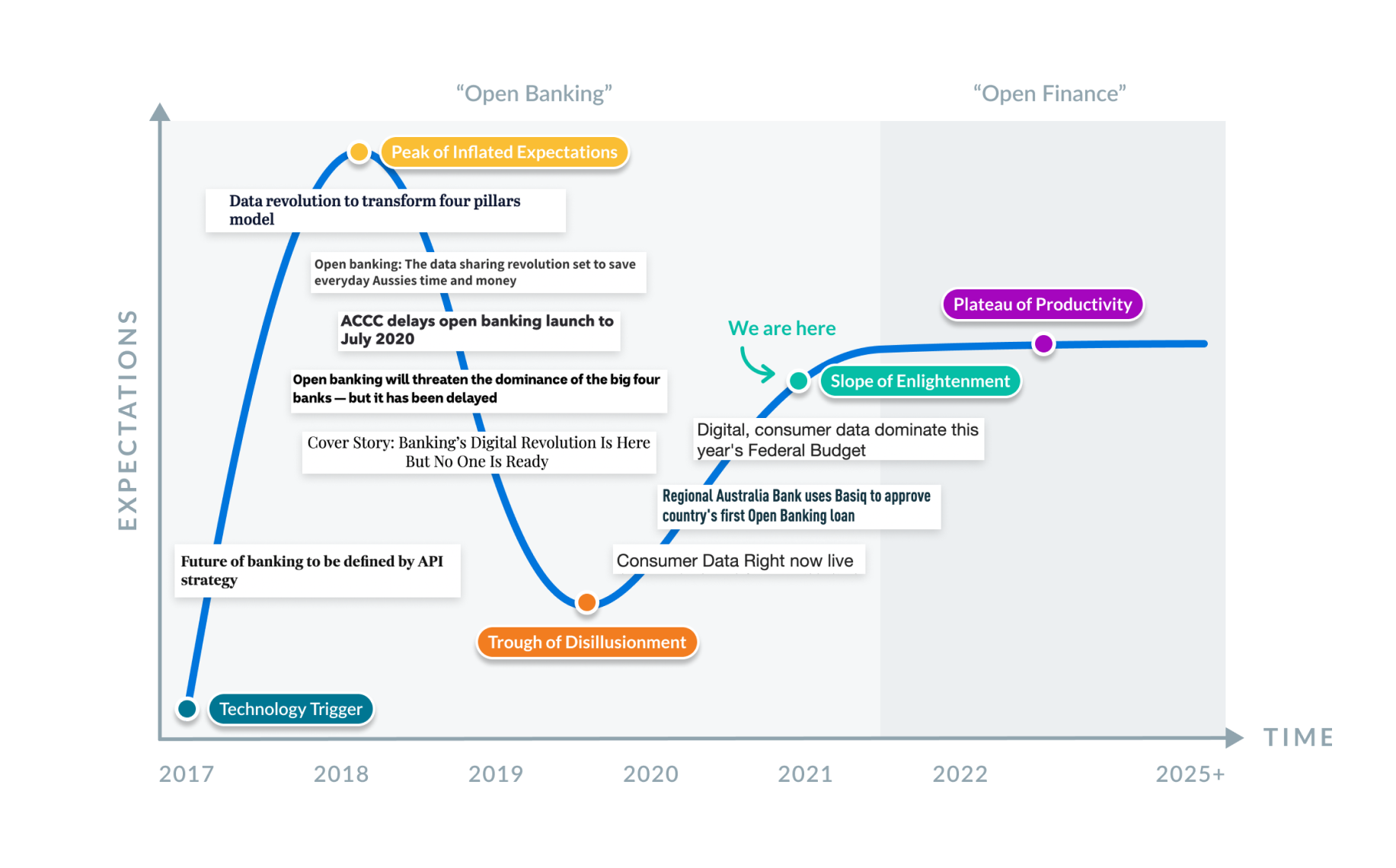

- Mapping the multiple stages of open banking to each stage of the Gartner ‘Hype Cycle’, suggesting a move toward an Open and Embedded Finance model:

- Four novel case studies from autonomous finance to green fintech, exposing a futuristic look at the pragmatic applications of Open Banking.