Basiq announces five new customers to access Open Banking

Basiq has announced Pearler, Way Forward, The Payment App, Otivo and Fonto as new customers under the CDR Representative model who can now access Open Banking data. Basiq becomes the first Unrestricted Accredited Data Recipient (ADR) to provide access to both CDR and non-CDR data for customers under this arrangement.

The adoption of the CDR Representative model shows that fintechs are keen to access and use Open Banking data. As an Open Finance platform that provides access to Open Banking, Basiq supports a number of use cases including lending, wealth & investing, bnpl, personal financial management, charities and payments. The new customers announced demonstrate the breadth with which financial data is used in providing a fintech service across a variety of segments.

Pearler is an investment app that aims to help everyday people invest simply, to build wealth and share their journey. Partnering with Basiq enables Pearler to assess the financial standing of individuals and help them build their wealth with simple, automated share investing.

Way Forward is a not-for-profit organisation that provides a free service for consumers to help them get out of financial hardship and reduce their debt faster. Using the Basiq platform enables Way Forward to get a deeper understanding of a consumer’s financial situation.

The Payment App provides smart datatech and fintech solutions to businesses through data services, payment services and the development of apps. Through Basiq, it will enable partners and clients to facilitate richer user engagement through increased financial intelligence.

Otivo empowers people to take control of their financial future by providing personalised financial advice online. Using Basiq, Otivo is able to better understand their customer’s financial needs in real time, ensuring their advice is always relevant and up to date.

Fonto enables companies to validate, connect and understand consumers quickly and accurately. By partnering with Basiq for daily financial data, Fonto can generate deeper insights across dozens of categories.

With access to Open Banking alongside existing methods, the Basiq platform provides customers with the ability to use financial data for a number of different use cases in getting the most complete view of end users. This includes the ability to verify identity by validating account ownership, drive personalisation by generating insights from financial data, and initiate actions such as payments.

“We’re really excited to be working with customers in enabling them to access and use Open Banking. We understand how complex accessing Open Banking can be and we’ve worked closely with them to simplify the process. Our focus is on removing the complexities so our customers can focus on building and enhancing their fintech services” says Damir Cuca, CEO and founder of Basiq.

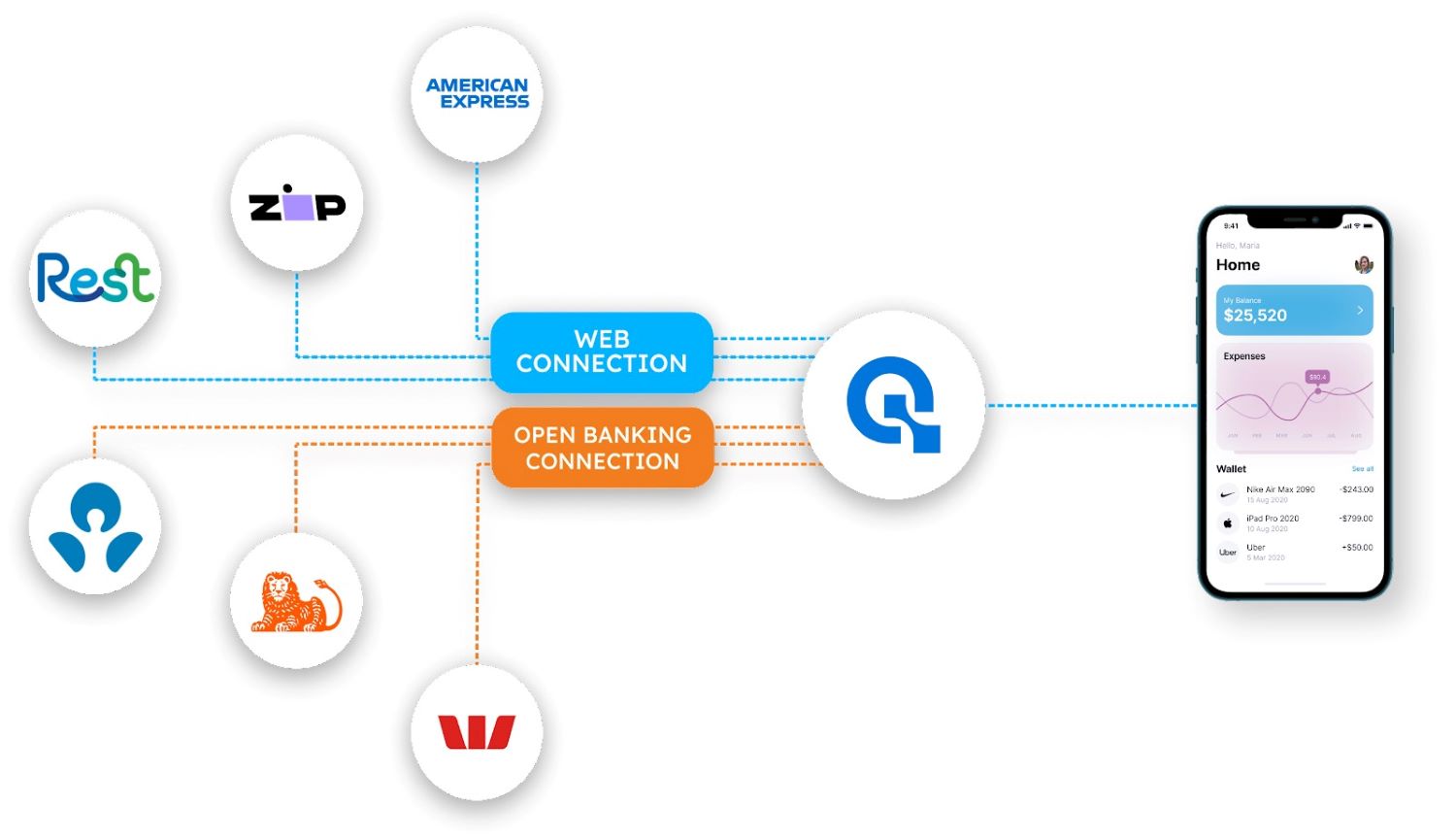

One of the ways Basiq has simplified access is through its recent announcement on its platform upgrade. The Basiq 3.0 platform helps deliver a more complete picture of end-users, minimising complexity by providing a single API to access multiple data sources. Using a platform such as Basiq that can access

CDR and non-CDR data is important while Open Banking is in a transitory stage. Not only does Basiq 3.0 access CDR Open Banking, the platform also provides connectivity to financial institutions that are not yet part of Open Banking such as alternate lenders, card issuers, investments and BNPL services.

“The Basiq 3.0 platform provides a way for our customers to obtain an ongoing view of their end users’ financial position using multiple data sources. Using Basiq 3.0, Fintechs can incorporate CDR Open Banking data as well as data from non-CDR sources. We’ve taken the heavy lifting out of accessing and normalising data from multiple sources including Open Banking so it can be used in a meaningful way” says Cuca.

One of the challenges with accessing CDR Open Banking was that you had to be an ADR in order to use the data – something which requires an organisation to go through a complex process to be accredited by the ACCC. At the time of writing there are 30 organisations who are ADRs. However, both Treasury and the ACCC were quick to respond to industry concerns last year by making amendments to Version 3 of the CDR rules to include ‘Access models’ to accelerate participation.

One of these models is the CDR representative model that enables un-accredited persons to provide services to consumers using CDR data under an arrangement with an ADR such as Basiq. A full list of CDR Representative arrangements can be found on the CDR website here.