Award-winning fintech Sharesight uses API technology to transform wealth management

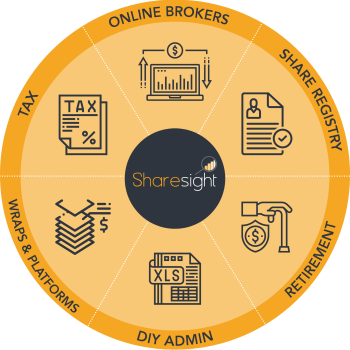

Award-winning online portfolio tracker, Sharesight, has seen rapid growth in its fintech ecosystem, which consists of leading global brokers, robo-advisers, research providers and wealth management platforms.

The portfolio tracker, which provides performance tracking and tax reporting for over 240,000 global stocks, ETFs and funds, is currently partnered with 25 leading fintech companies via the platform’s API technology, with more key partnerships planned for 2022.

“The Sharesight API is an industry-leading technology that allows us to collaborate with other financial platforms to create new, superior digital solutions for wealth management,” says Doug Morris, CEO at Sharesight.

“Some of these solutions allow investors to automatically sync trading data from their broker(s) to get a full picture of their portfolio’s performance in Sharesight; or to automatically sync cash balances, trades and dividends between Sharesight and Xero – an invaluable feature for investors and financial professionals preparing tax returns.

“We have also integrated our performance tracking capabilities into other wealth management platforms, giving investors the full picture of their net worth and empowering them to make better financial decisions.”

With many investors now trading through multiple brokers, some of Sharesight’s most successful partnerships have been with leading brokers such as CMC Markets Stockbroking.

“We were actually the first broker to integrate with Sharesight’s portfolio tracking software,” says Andrew Rogers, Head of Stockbroking at CMC.

“We saw a lot of value in building to the Sharesight API because it allows us to continue providing investors with a world class trading experience, while also giving our customers access to Sharesight’s advanced performance tracking and tax reporting tools.

“One of the key benefits of Sharesight’s API technology is that it allows companies to expand their product offering and add value for their customers without the time and financial commitment that would otherwise be required to build these features from the ground up,” adds Morris.

Recently, Sharesight has also launched a wave of new partnerships, with some of the most popular being low-cost brokers that specialise in auto-investing, such as Australia and New Zealand-based brokers Pearler and Sharesies.

As a platform designed to help people reach their financial goals through long-term investing, Pearler saw the advantage of integrating with the Sharesight API to create a bigger and better solution, allowing investors to automate both their investments and their performance reporting. The partnership has expanded Pearler’s service offering, with a customer uptake comprising almost one-third of Pearler’s user base.

After receiving countless requests for an integration between Sharesies and Sharesight, Sharesies also found that within just a week of launching the partnership, there were already thousands of customers taking advantage of the ability to sync their Sharesies trades to their Sharesight portfolio.

Sharesight is also partnered with a range of media outlets via the platform’s RSS feed, which provides investors with the latest news for stocks on the ASX, LSE and all major US markets.

The portfolio tracker, which officially launched its Partner Program this year, has plans to further expand its partner ecosystem via integrations with a range of financial advice platforms and digital brokers.