Stake unlocks $31 trillion US share market for Aussies, launching new trading app

Rapidly-growing Australian fintech startup Stake is set to revolutionise trading and open up direct access to the $31 trillion US stock market as its new trading app launches today. The app is the first to give Aussies access to more than 3,000 shares to invest in some of the world’s biggest companies with $0 brokerage, right from the palm of their hands. The app launch comes as Stake announces significant company growth. More than $50 million (US$38 million) has been transacted on the site, with more than 39,000 trades and 12,000 users who are taking advantage of low-cost, simple direct access to the US market. This next big milestone — […]

Independent Reserve launches Ripple

Independent Reserve, the Australian digital currency exchange, will commence trading in Ripple (XRP) on 7 July, 2018. All XRP trades will be discounted to 0.1% for the first two weeks. XRP is the third largest digital currency by market cap after Bitcoin and Ether. Developed by Ripple Labs, the protocol and currency were designed with the banking and institutional market in mind, enabling fast, low-cost transfers between fiat currencies as well as other assets including gold and airline miles. Ripple Labs has partnerships with a wide range of institutions around the world including NAB, Westpac and American Express. Its current market cap is around USD $18 billion. One XRP is […]

CXi sets course for scale up

CXi Software has ended the financial year with a strong quarter of activity, as it moves from a “start up” to a “scale up” business model. The company made a number of new senior management appointments in March and April – which preceded a move to new (and larger) premises on Queen Street in Melbourne’s CBD. The company also completed a Series A capital raising over the same period. New staff Adam Gernon was recently appointed as Chief Technology Officer, joining CXi from CenITex, where he was General Manager, Innovation and Delivery. Prior to CenITex, Adam had over 10 years’ experience in financial services technology at organisations such as NAB, […]

Australian FinTech company PokitPal and Booking.com sign global agreement

Australian FinTech company PokitPal, and Booking.com, the world leader in booking accommodation online, have signed a global agreement which gives PokitPal consumers cash back when they complete a transaction with Booking.com to further engage with the millennial and mobile-first markets. The new global agreement means PokitPal users can receive five per cent cash back on more than 28 million accommodation listings as well as flights, car rentals and airport transfers in 228 countries. Users simply need to book via the PokitPal App to receive the cash back reward. PokitPal CEO Gary Cobain said offering cash back to a PokitPal user’s bank card simply by using their app is a new […]

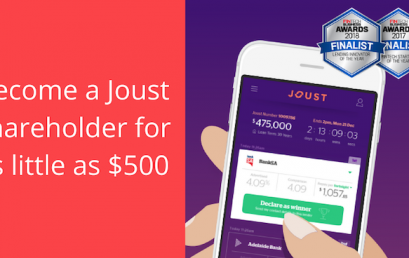

Adelaide fintech startup Joust seeking to raise $2m in Equity Crowd Funding

Adelaide fintech startup Joust is launching an equity crowdfunding campaign via OnMarket and is hoping to raise $2 million to rapidly scale the business. The Joust platform, launched in 2016, links borrowers with more than 20 lenders who compete against each other to offer the lowest interest rate via a reverse auction process. Using equity crowdfunding platform OnMarket, the company plans to spend a large portion of the money raised on advertising, with the remaining funds to go towards product development, potential entry into overseas markets and building out the Joust team. A minimum $700,000 is being sought as part of the capital raise, which allows retail investors to invest between $500 […]

AstuteWheel launches new Astute Insurance Planner solution

AstuteWheel has today launched its latest fintech solution, Astute Insurance Planner, which enables advisers to provide better risk advice more efficiently. The solution, which reduces the time taken to prepare risk advice to about an hour integrates three FinTech software systems to provide one seamless solution. It includes an online mini fact-find and risk needs analysis calculator, created by AstuteWheel; a risk research and quoting tool, which is an integrated OmniLife App; and a Workflow, Statement of Advice wizard and CRM provided in Seido. Seido is an integration hub designed by YTML to solve the connectivity challenges advice businesses face when delivering advice. Hans Egger, Managing Director of AstuteWheel, said, […]

Milliman and Ignition Wealth announce synergistic collaboration

Milliman Australia Practice Leader Wade Matterson and Ignition Wealth CEO Manish Prasad today announced a global collaboration between their two firms to combine Ignition Wealth’s integrated bank grade white label digital engagement and advice solutions with Milliman’s analytics, data and consulting prowess. Wade Matterson, Practice Leader, Milliman Australia and Manish Prasad, CEO, Ignition Wealth said, “We are delighted to announce a symbiotic new collaboration between Milliman and Ignition Wealth. Our businesses share a commitment to enrich the advice experience and enable better financial outcomes for every consumer.” The relationship has grown naturally from multiple synergies including an emphatic consumer-centric focus, growing global footprints and equally matched best in class status […]

This Aussie fintech is now helping give banking services to rural communities in Syria

Novatti Group Limited, an online financial transactions processor and financial technology developer, announces it has entered into a supply agreement with Banque Bemo Saudi Fransi (BBSF). Novatti has entered into the supply agreement with BBSF to supply its agency banking services and mobile payments platform. BBSF is a leading and trusted bank among Non-Government Organisations (NGO’s) that has been operating in accordance with global banking standards providing retail-banking services for 14 years. Under the NGO umbrella, a key program of the bank is to enable distribution of financial aid to rural consumers within Syria, most of who are not catered for in the current banking space. The platform being supplied […]