UK Tech Rocketship Awards take off in Australia and New Zealand

The UK’s Tech Rocketship Awards offer Australian and New Zealand technology scale-ups a new launch-pad for their expansion to the UK. On the hunt for successful Australasian technology scale-ups, the UK Department for International Trade (DIT) has launched its Tech Rocketship Awards in Australia and New Zealand. The Tech Rocketship Awards are open to established Australian and New Zealand scale-ups who deliver innovative, technology-led solutions across a wide spectrum of industries and are ready to internationalise. The Awards will help 8 winners gain exposure, expand their global networks and expedite the set-up of their UK operations through a paid-for, personalised trip to the UK in early 2019. So far, over […]

New partnership sets out to educate the SMSF community in cryptocurrency investments

Cointree one of Australia’s leading cryptocurrency exchanges has partnered up with My SMSF, a specialist provider for property and niche assets. The partnership aims to deliver clarity for people wanting to invest their super in cryptocurrencies. Cointree is one of Australia’s fastest growing digital currency exchanges with now over 60,000 members. Through their community, affiliates and partners, Cointree continues to see a growing interest in investment opportunities in cryptocurrency using a members Self Managed Super Fund (SMSF). “Since our announcement of entering the SMSF space, we have gained a lot of interest from our members and the general public wanting to invest into cryptocurrency using their super,” says Shane Stevenson, […]

Irish fintech Priviti launches in Sydney as Australia prepares for Open Banking and the Consumer Data Right

As Australia prepares for its new Open Banking standards and the Consumer Data Right, Priviti, the global fintech company, is helping banks get ready to comply with new legislation and empower consumers with greater control over how their personal data is shared. Its extensive experience with global data protection laws such as PSD2 and GDPR means Priviti has seen the paradigm shift in the way financial organisations and individuals view their data, and how their systems need to change, explains Dermot McCann, Priviti’s Head of APAC. “Every day a bank is potentially engaging in new activities that could impair their compliance, particularly now in this new era of Australian Open […]

Peppermint signs agreement with Philippines’ electronic payment service provider, ECPay

ASX-listed Peppermint Innovation Limited announced it had signed a Memorandum of Agreement with Electronic Commerce Payments, Inc. (“ECPay”), a leading electronic payment service provider in the Philippines. Under the agreement, customers can use Peppermint’s Bizmoto website (www.bizmoto.com.au) to directly pay a variety of bills for their family and friends living in the Philippines, such as power and water, mobile phones and the internet. They can also directly top-up credit cards and debit cards for their family and friends, as well as paying insurance premiums or loan and finance repayments. The direct payment of bills and purchase of e-Loads is viewed favourably by some payees who are reluctant to transfer cash […]

Xero State of Lending Report: Funding gap is stifling small business growth in Australia

Research unveiled today by Xero suggests Australia’s small businesses could borrow as much as $80 billion over the next 12 months, if they could get the funding. Instead, small businesses are struggling to access the capital they require, in large part due to the complexity of the loan process. This is creating a funding gap and holding back significant jobs and growth opportunities for the Australian economy. According to the Xero State of Lending Report, one in five small business owners (22%) say access to capital is the greatest pain point or perceived threat to their long-term growth aspirations, and a quarter of small business are not very confident in […]

CoinJar exchange lists Zcash (ZEC) offering world first ZEC/AUD order book

CoinJar has expanded its offering by listing Zcash (ZEC) in its portfolio, meaning that for the first time in Australia, cryptocurrency traders and investors will have access to a ZEC/AUD trading pair using an order-book through CoinJar Exchange. Zcash (ZEC) is a leading privacy coin and will be listed alongside Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) and Ripple (XRP). Traders and investors can hedge their ZEC holdings against major fiat pairings including Australian Dollars (AUD), Great British Pounds (GBP), Euros (EUR) and US Dollars (USD) to temporarily protect their portfolio from price fluctuations. CoinJar customers will now be able to send and receive Zcash with their CoinJar wallet, pay bills […]

Brisbane entrepreneurs make buying bitcoin easy

Digital Surge has removed all of the complications of other exchanges, making the purchase and trade of Bitcoin as simple as internet banking.

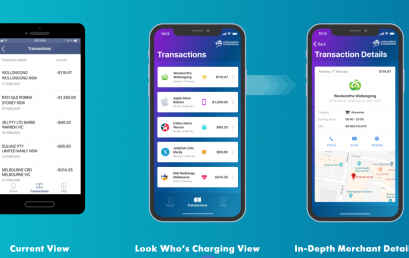

Local FinTech Look Who’s Charging eyes offshore expansion

Local FinTech start-up Look Who’s Charging has been selected as one of only 24 companies from around the globe to present their business on the centre stage at Money 2020 in Las Vegas this coming October. Look Who’s Charging is a Data as a Service business and one of the first companies globally to solve the problem of unrecognisable transactions. Look Who’s Charging links the often-random narratives from debit and credit card transactions to in-depth merchant details. NAB integrated Look Who’s Charging into their digital applications earlier this year. In the past 12 months Look Who’s Charging has helped to de-mystify over 15 million transactions many of which would have […]