How the power of automation could help your financial institution boost customer lifetime value

Orchestrating a continuous series of personalised, positive interactions can boost product uptake, loyalty and profitability.

A turning point for stablecoins: U.S. regulation sets the global standard

To give some scope of the scale of the stablecoin opportunity, the market capitalisation of stablecoins globally now sits at approximately $230 billion.

ThirdEye releases Transaction Monitoring System Buyer’s Guide for Financial Institutions

A new buyer’s guide aims to address the growing challenge faced by mid-sized financial institutions when selecting transaction monitoring systems.

Iress partners with interop.io to deliver future-ready trading experiences

Iress has partnered interop.io as part of the company’s broader strategy to focus and reinvest in its core trading and market data products.

Introducing Australian FinTech’s newest Member – Spendi

Introducing Spendi, the innovative app set to revolutionise spending habits without changing the way you shop.

Experian and GBG deepen strategic partnership to strengthen fraud prevention and identity verification

Experian and GBG announce an expanded partnership, reaffirming their shared commitment to helping organisations protect consumers from identity fraud and financial crime.

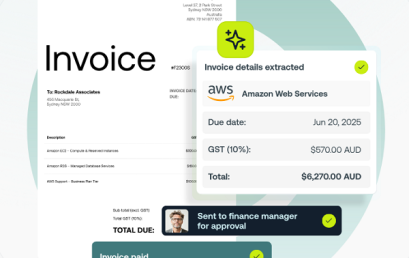

Weel launches AI-powered Accounts Payable solution

Weel has launched its all-new Accounts Payable automation suite – an end-to-end solution designed to eliminate the complexity of traditional AP workflows.

finPOWER Australia appoints Theresa Reidy as new Head of Account Management

finPOWER, a leading provider of loan management and origination software, have announced the promotion of Theresa Reidy to Head of Account Management.