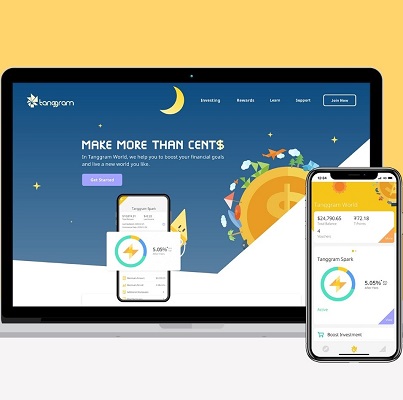

Australian FinTech company profile #86 – Tanggram

- Company Name: Tanggram

- Website: www.tanggram.com

- Key Staff & Titles: Nick Tang (Founder & CEO), Derek Li (Co-founder & CTO), Connie Ren (Co-founder & CMO), Demi Xu (Co-founder & COO)

- Location(s): Melbourne, Australia

- In one sentence, what does your fintech do?

Tanggram is the first Smart Wealth Creating Platform in Australia.

- How / why did you start your fintech company?

Our business started back in 2013 providing professional wealth management services to over thousands of both local and overseas clients including HNWs. During the process, we found that many of our clients came across similar difficulties when they needed financial services. The service fee was too high, the paperwork was too complicated, and the application process was taking too long etc. We also found the demographic of our clients had changed time by time. More and more young people need supports to manage their wealth. We would like to solve these existing problems with innovative technologies. This was the original intention of building Tanggram.

The idea was first born in 2016. Literally when we first started, we started from one person and one desk. And now we got a team of passionate and energetic people with nearly half of them are females. We were honoured to join Fintech Australia when it was first established. It is beneficial to stay on top of the industry leading technologies within the innovative communities. We have also partnered with one of the largest overseas wealth-tech firms to co-develop our business. In terms of funds raising, we have raised over $3million AUD in angel and seed round. And we have been talking closely to VCs both in Australia and overseas to lock in the next series A capital raising recently.

- What’s some advice you’d give to an aspiring startup?

Stay focused on our initiatives. Good product and service is the key. Take the best interest of clients as the priority when making every big decision.

- What’s next for your company? And are you looking to expand overseas or stay focussed on Australia?

We will continue to expand our presence across the Australian market, while also launching campaigns across China and southeast Asia to provide the similar service in the next few years. We are also excited to be working on an AI-driven portfolio algorithm that will support and bolster our growth.

- What other fintechs or companies do you admire?

We like open banking implementations such as TrueLayer and SplitPayments. It provides easy access to banking infrastructure. We also like Raiz and Afterpay who help educate the market with mobile investment.