Australia wants to be more competitive in the crypto space, but what does that look like?

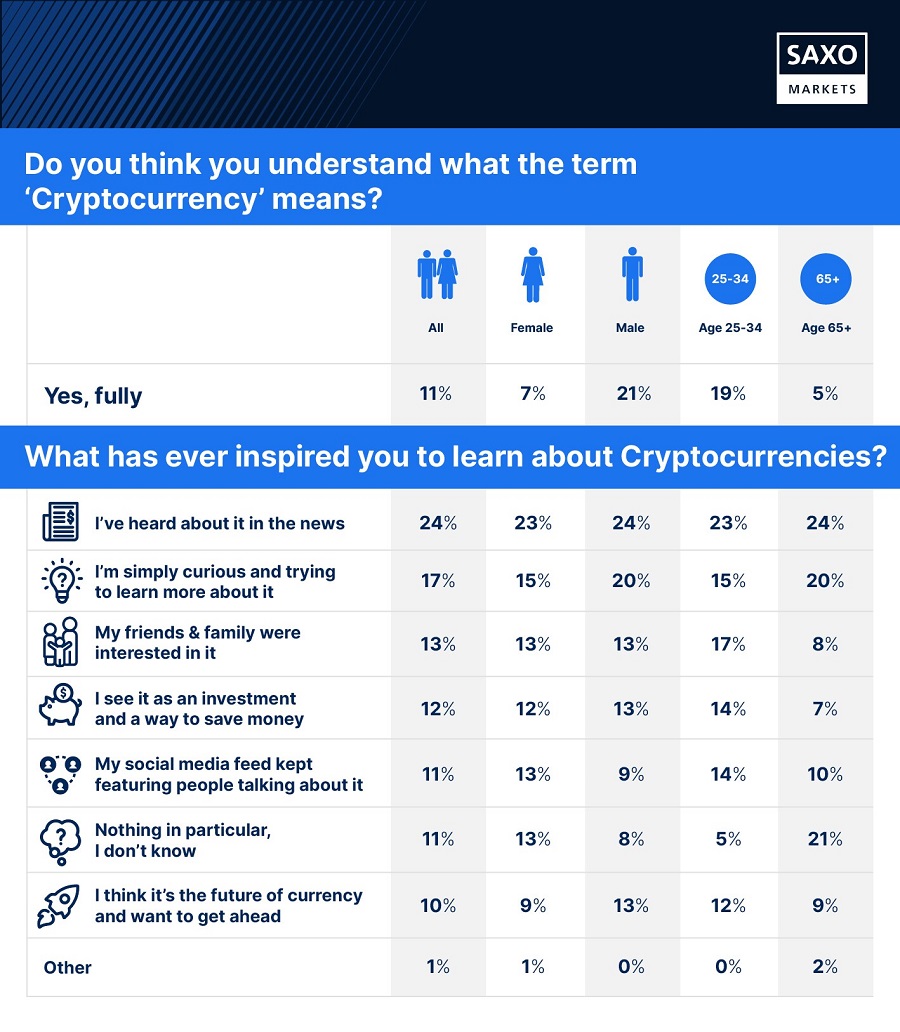

Saxo Markets surveyed Australia’s general population to get their thoughts and attitude on Cryptocurrencies, and whether or not it has the scope to be a competitive currency in the near future.

Cryptocurrencies like Bitcoin, Ethereum, and other decentralised financial assets have progressed with such scale and speed over the years that it has even surprised regulators, policymakers, and government bodies worldwide. Recently, mainstream adoption by financial institutions like Morgan Stanley and high-profile figures like Tesla CEO Elon Musk has allowed the size of the global crypto market to continue climbing, reaching $1.49 billion in 2020.

Fast forward ten years, the size of the market is expected to have a value of around $4.94 billion. As a result, there has been an even bigger push for jurisdictions to create regulatory frameworks that will help give market participants and project developers certainty and protection. The United Kingdom, the United States, and Singapore lead the current crypto era, notably the last, which offers favourable income tax laws. Singapore also does not have capital gains tax (CGT).

Interestingly, Australia is one country that has expressed a recent desire to compete against the UK, US, and Singapore in the cryptocurrency sector. In October 2021, Australia had the third-highest rate of cryptocurrency ownership, and according to Australian Senator Andrew Bragg (who was elected in 2019 and is a member of the Liberal Party), Australia has the potential to become a significant leader in digital assets. However, Bragg concluded that this would only happen if the sovereign country develops an appropriate regulatory framework for cryptocurrencies. The Senator added that improved regulatory structures would also give Australians more control over their finances and access to new choices and lower prices.

A New Era for Australian Finance

Even though digital currency exchanges have registered since 2018 with AUSTRAC, an Australian government financial intelligence agency, and recent survey data indicates 42% of Australians would use cryptocurrency if it was a legal tender, the country’s crypto and blockchain industry has still been slow to develop. We can attribute this to Australia not removing decades-old laws dealing with the new technology, which is a reality that has sent several prominent Australian-founded digital currency exchanges elsewhere over the years. For instance, in September 2021, the Australian crypto exchange Independent Reserve became the first to acquire a regulatory license in Singapore. Similarly, CoinJar UK, the UK subsidiary of the longest-running crypto exchange in Australia, received registration from the UK’s Financial Conduct Authority (FCA) in 2021.

To read more, please click on the link below…