Aussie SaaS fintech Nine25 launches world first payroll/HR tech platform into Australia’s hottest jobs market

Australian SaaS fintech Nine25 today launches its world-first Salary Streaming and budgeting platform that enables users to manage their bills using their salary tracked in real-time.

Australia is experiencing a talent crisis, with one unemployed worker for every available position, Nine25 aims to help solve retention and attraction problems, offering employers a new way to compete in a competitive market with its unique solution, which solves the problem of financial stress for its employees in a truly meaningful way, for the first time.

Unlike other ‘budgeting’ platforms who claim to budget by creating dashboards and reporting, Nine25 is a first of its kind software-as-a-service platform that actually budgets for its users by actively allocating funds to their bills using authorisation to live employment and banking data.

Nine25 allows its users to manage their bills, spend, and grow their wealth on a fixed-price subscription model, which is the first of its kind in a market that’s become accustomed to outdated revenue models like transactional fees, repayment fees and late payments.

What differentiates Nine25 from payday lending and high-interest models is that we are a first-to-market SaaS model. Nine25 has developed a subscription model specifically to disrupt every other model that exists on the market today. Users are not charged interest or late fees and have predictable cost access to the platform which includes the real-time salary.

Aussie startup Nine25 is the first fintech globally to solve budgeting and salary management in one app and is the brainchild of entrepreneur Leigh Dunsford who co-founded accounting software platform Waddle, a leading global lending enterprise SaaS platform that was acquired by Xero in 2020 for $80 million.

Known for his ability to successfully disrupt traditional financial industries, Dunsford is calling on Aussies to break up with their banking and budgeting apps, leaving bad habits behind and wants to create a generation of financially independent customers. Dunsford believes that financial independence is about being in control of your expenses and investments and the first step towards financial independence is controlling your salary and having it work for you, something he feels isn’t being done, till now.

Nine25 is solving a genuine user problem that no one else has managed to solve, to manage and pay off bills in real time. Other apps and platforms have tried to create a digital version of the “envelope system”, creating different envelopes, accounts, buckets, jars for different bills. Nine25 is the first and only platform to use the technology to allocate users’ salaries in real-time creating a brand new product and solution.

“Every money management app in the market right now is backward facing and unhelpful,” says Dunsford, “They look back at your previous spending habits and tell you how you failed and missed your targets. Or they’ll repackage the same old banking product, slap on a fancy name, and talk about savings goals but the only thing they really care about is getting you to deposit your salary with them rather than the next bank,” he said

“We’re not just rewriting how Australia’s workforce receives and manages earned income; we’ve built a platform that enables a seamless real-time pay experience,” says Dunsford. What Nine25 has done is align a user’s bills and expenses with their real-time earnings. “Salary Streaming™” is a first of its kind technology that integrates directly with either your payroll system, or HR platform, or time and attendance system,” says Dunsford.

“Whether it’s the tips from the end of your shift, your delivery fee from the food order you just dropped off or your salary every hour, the money you just earned will Stream into your Nine25 App and be allocated towards your bills, savings and commitments in real-time,” says Dunsford.

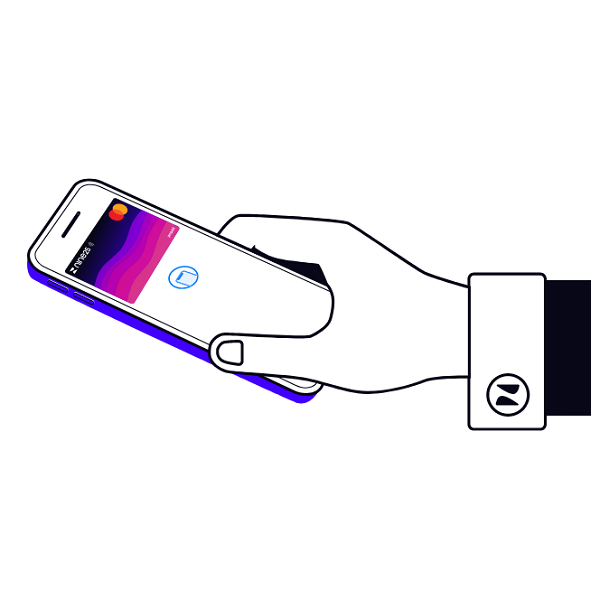

Nine25’s initial rollout will see the launch of its Salary Steaming service made available to Australian customers, and in the coming months will offer a first-of-its-kind Nine25 Card in partnership with Mastercard® that will enable customers to spend money they have earned directly from their Nine25 Account in real-time.

“Imagine you’re waiting in the queue at a coffee shop. You refresh the App, tap the phone and use the $3.50 that you just earned to pay for your coffee. Or you’re a delivery driver that just completed a delivery. Your fee just streamed into your Account and you use the funds to fuel up your car” explains Dunsford, “no transfer to bank, no checking your bank balance, no debit card. This is genuinely real-time salary streaming.” The business has partnered with a Investing-as-a-Service platform to offer first to market invest-as-you-earn services in 2023. “People talk about the value of dollar-cost-averaging by investing regularly every month,” says Dunsford, “imagine the compounding effect and wealth creation that comes from investing as you earn, every day.”

Nine25 has no intention in getting an Authorised deposit-taking institution (ADI) licence of its own, instead it is underpinned by banking technology, every user is issued a Nine25 Account that has its own BSB, Account Number and PayID, that’s connected directly to their salary and Nine25 Account monitored through the app’s integrations.

“Nine25’s digital wallet and payments technology is facilitated by Zai, a global financial technology company delivering embedded finance orchestration. Zai partners with Standard Chartered Bank based in London, a leading international bank that serves customers in almost 150 markets worldwide, employing 85,000 people.”

Nine25 integrates directly into payroll systems which is the single source of truth for a person’s employment status and salary. By sending their salary to their Nine25 Account, their salary gets working from the minute it is earned. Users who subscribe and use the Nine25 App won’t be stung with large interest fees or late payments like payday lending solutions or BNPL, instead they are charged a 0.33 cents a day fee for using the app, a plan to reduce the subscription closer to nil as it continues to deliver value added products is already underway.

Nine25’s streaming model is powered by integrations that are built into various payroll systems that allows Nine25 to verify a user’s salary and income, then grant them access to stream their salary as they earn it with a direct payments facility that helps users manage their bills and finances in one app.

Backed by Equity Seed who invested $3.2 million in late 2021, Nine25 is pioneering salary and financial independence and will be releasing over 50 integrations in the next 3 months covering an estimated 80% of the payroll and gig economy market. Through these integrations and partnerships, Nine25 aims to make its Salary Streaming technology available to 3 million users in the next 6 months. Once these partnerships are live, it will position Nine25 as the fastest growing Australian fintech with the largest customer acquisition growth in the marketplace.