ASX-listed fintech Douugh launches new Merchant payment gateway, Douugh Pay

Douugh, the award winning fintech on a mission to enable more efficient money management through its embedded finance technology platform, have announced the launch of its Douugh Pay product with online merchant partner Tokorepair as well as provide a trading update for the month of January 2024.

As previously communicated to investors, central to Douugh’s scale up strategy of its direct to consumer (B2C) offering is via merchant partnerships, with the launch of its new Douugh Pay product.

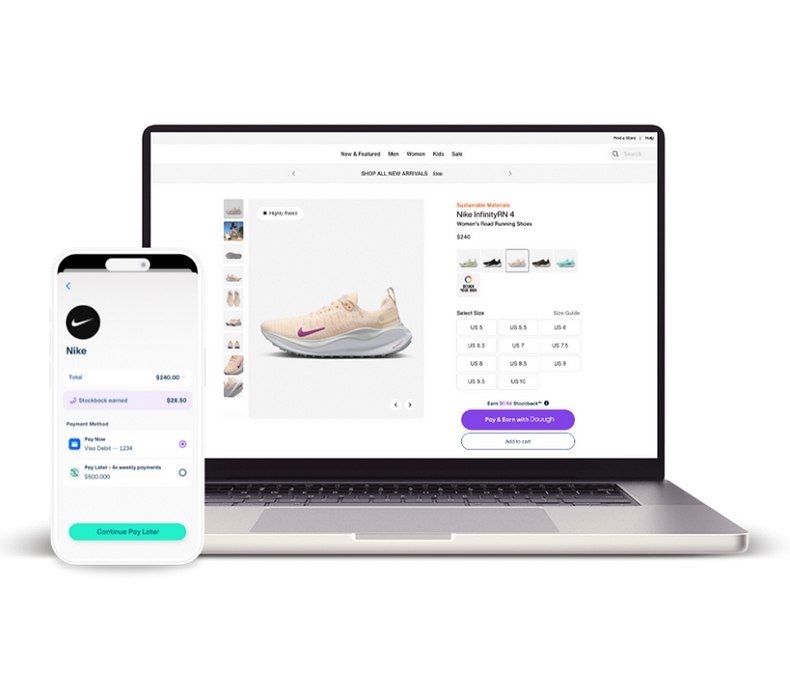

For the first time, merchants are able to offer their customers Douugh’s unique Stockback™ reward program, with the flexibility of ‘Pay Now’ or ‘Pay Later’ features integrated into a seamless checkout experience at point of sale.

Payments are automatically debited from a customer’s connected Visa/Mastercard debit (Wallet) or Douugh line of credit (Spot), depending on the customer’s preference at checkout.

The Douugh Pay solution is designed to be open loop and have mass market appeal, with the goal of appealing to key customer cohorts that will be attracted to grow their money as they spend by earning Stockback™ (Cashback rewards that are invested in a customers chosen managed Portfolio), as well accessing interest-free credit at POS through the click of a button.

The company expects it will see a higher weighting of debit vs credit transactions across its customer base, as it looks to focus on upselling customers to set up a recurring investment savings plan on the Douugh platform.

Douugh is handling end-to-end settlement with the merchant and the customer. Stockback™ rewards will be funded directly by the merchant, with Douugh charging a processing fee of ~1.75% + 30c.

Spot loan growth

Douugh has also continued to diligently organically grow its loan origination activity in the month of January from its existing core group of customers. Douugh is seeing consistent repeat drawdown behaviour which is equating to high life-time value (LTV). There is no doubt that the new feature has achieved product market fit, as customers seek convenience, flexibility and immediacy to help them manage their cash flow.

The company originated a total of 211 Spot loans, equating to ~$35,000, with 90+ day defaults now sitting at 5.77%. It is expected that loan origination will accelerate as new merchant partners are onboarded and overall total transaction volume (TTV) increases as more customers choose to ‘Pay with Douugh’ at checkout.

On top of this, Douugh is also now negotiating with key finance brokers to deliver a high volume of qualified leads to the Douugh platform.

Stakk by Douugh (B2B)

With over $7 million of shareholder capital invested into the technology platform over the past 36-months, Douugh has successfully developed and deployed one of the industry’s most comprehensive and multi-functional Embedded Finance solutions – commonly referred to outside of Australia as Banking-as-a-Service (BaaS).

Designed not only to deliver key banking and investing capabilities in different regions across the globe, Douugh’s technology stack is principally focused on enabling more intuitive and efficient money management.

Initially deployed on a business-to-consumer basis (B2C) in Australia and the United States under the ‘Douugh’ brand, Douugh has continued to capitalise on its technology stack (and the shareholder capital invested in it), by making it available through a ‘business to business’ (B2B) model.

This B2B model, operated under the ‘Stakk’ brand, ‘powered by Douugh’, is generating monthly revenues of ~$55,000 which continue in February 2024. Although we anticipate continued growth in this area, we think shareholders will agree that initial revenues from this activity are meaningful at this early stage.

In its modular form, Stakk is a multi-functional offering, offered on an a-la-carte basis, that includes:

- Digital banking apps (native iOS, Android, and https white labelled apps)

- Online Account Opening (KYC, AML, Fraud Monitoring, Credit decisioning)

- Identity verification

- Account to account payments (including RTP)

- Banking (and connected accounts)

- Debit and credit card issuing (and program management)

- Checking and savings accounts (including DDA and Pseudo DDA’s in the U.S Market)

- US share trading

- Automated money management (budgeting, saving, investing)

- Instalment based credit (consumer & SME)

- Cashback & Stockback rewards

All functionality is API (Application Programming Interface) driven and complemented with certain Mobile SDK’s (Software Developer Kits) for rapid deployment. Perhaps most notably though, this highly efficient model makes the Douugh’s Embedded Finance solution appealing and accessible to Fintech providers, lenders, banks, credit unions and building societies, mutual funds, and other brands seeking such functions as part of their Embedded Finance strategies.

Commenting on the company’s announcement, Douugh’s Founder and CEO Andy Taylor said, “We are delighted to finally announce the full market launch of Douugh Pay with our first merchant partner Tokorepair. We strongly believe that partnering with merchants to help them create a deeper emotional connection with their customers, is the only way Douugh can cost effectively scale its direct to consumer (B2C) business.

“Our Stockback™ rewards program is a revolutionary new way for merchants to help their customers save and invest as they spend, whilst removing friction for consumers at checkout, providing them greater flexibility and security. Douugh Pay fundamentally gives merchants the hook they need to increase conversion and average order value in a way that cashback and points based rewards cannot.

“We expect this new channel to meaningfully contribute to customer and revenue growth from Q4 and look forward to updating investors on the signing of new merchant partners.

“We are also happy to report that we are continuing to see strong engagement of our short-term Spot loan product in the month of January, which is helping customers smooth their cash flow. It is certainly proving to be a sticky product with users, demonstrating high life-time value (LTV).

“As highlighted in our recent 4C, we have also been seeking to scale up revenue by sweating the technology asset of the business following the launch of our B2B services division Stakk, which is licensing our technology to third-party companies.”