Airwallex honoured by CNBC-Statista’s as one of ‘World’s Top Fintech Companies 2023

Airwallex, a leading global payments and financial platform, has been named to CNBC-Statista’s ‘World’s Top Fintech Companies 2023’ list. One of fifteen companies worldwide to have been awarded in the ‘Digital Banking Solutions’ segment,1 Airwallex was the only Asia Pacific-founded company to be selected in the category.

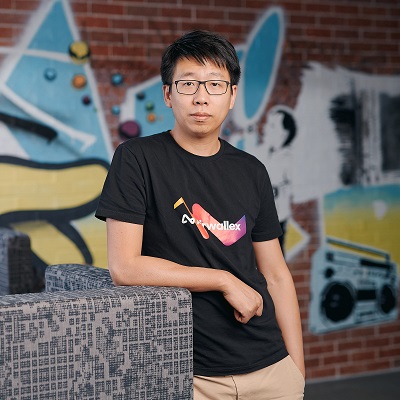

“More than ever, companies rely on innovation to facilitate growth and enhance their businesses’ productivity, efficiency, and security,” said Jack Zhang (pictured), Co-Founder and CEO of Airwallex. “We are excited and proud to be recognised as one of the World’s Top Fintechs leading the charge to challenge the status quo of money movement and provision of financial services, taking the friction out of the process and empowering businesses to go global.”

Zhang added, “From the beginning, we set out to build a financial infrastructure to support modern businesses that transcend borders in their financial services needs. This vision is what drives us onward as we continue to grow globally.”

First established in Melbourne, Australia in 2015, Airwallex is today the leading financial technology platform for modern businesses, providing global payments and financial solutions in more than 150 countries. Earlier this year, the company secured its online payments licence in China, and expanded into Canada and Israel. The company is growing global revenue by 120 percent YoY.2

Airwallex continues to innovate its product stack to deliver unique financial operating solutions for businesses of all sizes. Over 100,000 customers worldwide tap into our suite of products, including online payments, business accounts, corporate cards, treasury management, expense management, as well as embedded finance solutions that allow them to provide financial services to their customers natively within their platforms.

CNBC and Statista’s inaugural list assessed over 1,500 firms across nine different market segments, evaluating each one against a set of key performance indicators, including revenue, user numbers, and total funding raised. The final list includes some of the biggest companies in the sector as well as several up-and-coming startups seeking to mould the future of financial services.