A Deep Dive into Credfin’s Income Detection

By Jemima Moore, Credfin

Through Credfin’s powerful metrics, we offer accurate income detection, essential to our partners’ lending decisions.

Wages and Income Detection

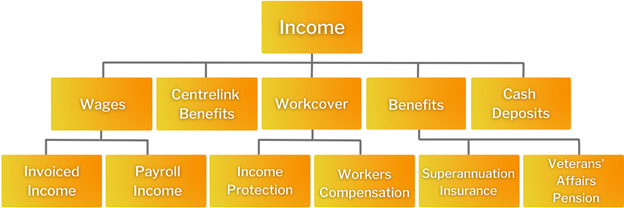

When detecting income, Credfin’s categorisation engine is able to sort the transaction groups into the following sources of income for the bank account:

This graph shows that income does not necessarily only include wages, as it can come from multiple sources. The more types of income we are able to detect, the more accurate the analysis can be. With Credfin’s smart algorithms, we are able to analyse what the active income sources are, then perform a comparison of their amount to ensure the larger is selected as the client’s income type (i.e. wage, Centrelink or Workcover), thus determining the primary source of income.

Trimmed Mean

When calculating average income for risk assessments, our income metrics return not only the arithmetic mean, but also the trimmed mean. The trimmed mean removes the outliers from consideration (sick leave, reduced hours, annual leave), thus gathering a more accurate overview of the client’s income, and in turn a better risk assessment. For example, if a once off deposit of $150 was calculated with other deposits that are $800 and above, the average would be inaccurate due to the inclusion of a once off deposit, and the client would be assessed at a lower income level than the correct amount. Isolating the extremities allows Credfin and lenders to perform a more accurate risk assessment.

Wage Detection

As wages are the most important type of income to consider in lending decision making, accurate metrics around wage detection are integral. With Credfin, you are in safe hands. To put it into perspective we process tens of thousands accounts a day, and roughly only 3 over the course of two months get misidentified. How’s that for accuracy?

Our wage metrics are able to:

Detecting if pay is irregular: We can detect large variations in transaction frequency and transaction amount, which indicates if a client’s pay is irregular (i.e. extremely casual employment or gig economy work). This metric can also be used to detect if there is a large sum suddenly deposited into the account. This could be a payout from the end of employment, thus is a key point to bring into risk assessments.

Estimate employment status: Credfin has two metrics that determine if a customer is still employed. The first is more lenient, as it consists of calculating the next expected income date with a tolerance of the absence of one income deposit (i.e. to account for potential annual leave and sick leave). We calculate the next expected wage date and compare it to the date of the application to see if it’s in the future, indicating the client’s employment is still active.

The second is more strict, where it does not permit the last wage to be absent, thus reporting if the last income is in the account or missing.

Unique to Credfin: Accurate Transfer Type Detection

One of Credfin’s unique abilities is the exclusion of internal transfers in our income considerations. For example, if someone were to send money between their own internal accounts, this is not income. Some competitors’ metrics do not acknowledge this as not income, thus giving the client an overinflated turnover of income and wages. With our accurate metrics, we are able to detect the internal transfers and exclude them from what we consider income and wages.

Other Non-Income Detection

Credfin is also able to detect transactions that are not considered income. This includes credit card cash advance and drawdown on loan accounts (home loan, personal loan, continuing credit contract).

Benefits for Lenders

All of the above points are beneficial for our lending partners, however we would like to address some more income detection metrics that suit lending in terms of risk assessment, determining repayment dates, and how we can assist you to make responsible decisions.

Firstly, our metrics enable financial data to be in a standardised, machine readable format which can be input into decision engines or automatically imported into third party platforms (i.e. underwriting platform, budget management application, mortgage applications, etc).

Credfin’s metrics are also able to work out if the client is maintaining their agreed loan repayment schedule by transferring the agreed amount in the period determined. These metrics can also determine if they have missed any payments. For example, we determine the scheduled amount and loan repayment frequency, and then determine if there are any missing loan repayments, thus giving ‘dishonour rate’ for attached loan accounts to give a holistic view of the client’s loan commitments.

Credfin can also offer lenders metrics which assist in determining correct repayment dates. These metrics help set the correct repayment date for approved loans based on wages only, and can be automated or used to check an underwriter’s date selection.

Bespoke Metrics

Lenders can also request bespoke income metrics. For example, if a lender does not want to include cash deposits into the income consideration, due to the irregularity and potential risk involved, Credfin is able to remove those metrics from that particular lender’s bespoke metric group. We can also create variations of metrics if the definition doesn’t exactly meet your requirement. Find out how Credfin can help your business today.