MOGOPLUS raises A$1.5 million in funding from London-based New Model Venture Capital

Sydney-based AI and data insights provider MOGOPLUS has raised A$1.5 million in funding from London-based New Model Venture Capital.

MOGOPLUS Insight Suite now on Google Cloud Marketplace

Data analytics and insight product vendor MOGOPLUS has announced its availability on Google Cloud Marketplace.

MOGOPLUS announces strategic partnership with Provenir

MOGOPLUS, an established data analytics and insight solution provider, has announced its latest addition to their partnership marketplace – Provenir.

MOGOPLUS’ AI position is strengthened with Google Cloud partnership as lending insight partner-of-choice

Every Open Banking participant in possession of a valid accreditation is in search of an ‘Insights-As-A-Service’ provider.

MOGOPLUS readies for A.I. push with Google Cloud Partnership and key Fintech industry hire

MOGOPLUS has strengthened its commercial team with the appointment of Ben ‘Fintech’ Ford as Growth Consultant.

Pennant Technologies partners with MOGOPLUS in Australia to accelerate lending value chain transformation

Pennant Technologies have entered in to a strategic collaboration with MOGOPLUS to bring product and service innovation to lending value chains in Australia.

MogoPlus, Adatree and Central Murray Credit Union collaborate to develop industry first Open Banking lending solution

This collaborative effort between Adatree, MogoPlus, and Central Murray Credit Union is revolutionising the lending experience for both financial institutions and their customers.

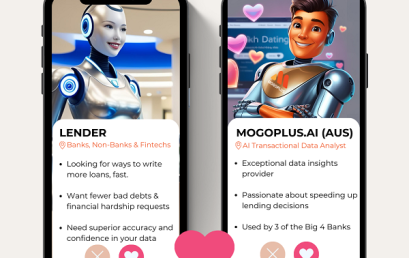

Introducing Australian FinTech’s newest member – MogoPlus

MogoPlus is a ground-breaking FinTech business providing data and insight solutions to businesses requiring straight through processing and instant decisioning outcomes.