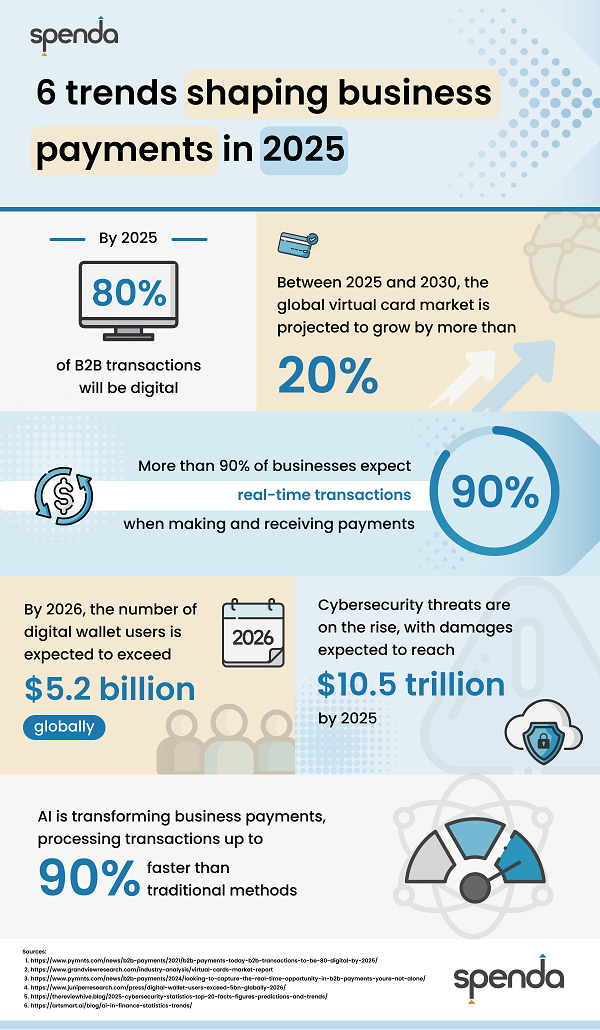

6 trends shaping business payments in 2025

The business payments landscape is changing fast and will continue to do so across 2025. As quicker and more efficient payment solutions become the norm, several key trends are transforming business-to-business (B2B) transactions. These include the rise of more digital payment solutions, increased use of automation to streamline processes, and a growing emphasis on security to protect against fraud. As businesses adapt to these changes, the way they handle payments will become more seamless, integrated, and efficient.

Here are some key statistics to give you an overview of the B2B payments market, both globally and in Australia. Spenda have highlighted some trends that are likely to impact the business payments landscape across 2025 and beyond.

1. By 2025, 80% of B2B transactions will be digital.

This change is driven by the need for faster and safer payments. Digital solutions cut down errors, improve cash flow, and reduce costs. Additionally, cash use is projected to decline by 40 per cent on a global scale, driven by a long-term shift towards digital payments.

2. The global virtual card market is projected to grow by more than 20% between 2025-2030.

The global virtual card market is currently valued at USD 19 billion and its growth is expected to continue. Virtual cards offer low-cost short-term business credit, making them an attractive choice for businesses looking to improve cash flow without the hassle and paperwork of traditional business lending.

3. By 2026, the number of global digital wallet users is expected to exceed 5.2 billion.

As more consumers and businesses embrace digital payments, digital wallets are becoming increasingly popular. This trend signals a strong shift toward digital-first solutions in financial transactions for both businesses and consumers. The use of digital wallets has also been steadily increasing due to the rise of mobile payments.

Digital wallets are mobile software applications that allow users to securely store and manage their payment information like bank cards. Think Paypal, Google Pay and Apple Pay. Their popularity is expected to grow as more consumers and businesses recognise the convenience and security that digital wallets offer.

4. More than 90% of businesses expect real-time transactions when making and receiving payments.

Real-time digital payments are no longer a luxury, they are becoming the standard. Surprisingly, cheques and cash are still used in B2B trade, but real-time digital transactions are quickly taking over due to their convenience and security.

According to recent global data, 96 per cent of manufacturers expect real-time digital transactions to replace cheques when making payments, while 87 per cent expect the same when receiving payments.

5. AI is transforming business payments, processing transactions up to 90% faster than traditional methods.

While Artificial Intelligence (AI) is still in its early days, its influence is rapidly expanding across all business operations, particularly in transforming payment processes. By 2025, AI is expected to play a significant role in streamlining invoicing, accounts receivable, and accounts payable, enabling businesses to achieve faster and more accurate payments.

AI-powered tools process transactions up to 90 per cent faster than traditional methods and automate up to 50 per cent of repetitive tasks like data entry and compliance checks. This reduces employee workload, minimises human error, and ensures quicker, more efficient financial services.

6. Cybersecurity threats are on the rise with damages expected to reach $10.5 trillion by 2025.

Evolving cyber threats make payment compliance crucial for protecting cardholder data, maintaining trust, and safeguarding information. By 2025, global cybercrime damages are predicted to reach USD10.5 trillion annually which showcases the importance of implementing robust cybersecurity measures.

AI-driven tools will be crucial for detecting and preventing fraud, with businesses increasingly relying on these technologies for risk management and transaction monitoring.

Transform your payment processes and get ahead in 2025

By 2025, digital payments and task automation will revolutionise business transactions. Using an integrated software and payments provider like Spenda can help your team automate tedious and time-consuming tasks, boost payment security, mitigate late payments, and enhance cash flow.

Spenda serves as both a software solutions provider and a payment processor, delivering essential infrastructure to streamline business processes before, during, and after the payment event. Their connected platform replaces multiple disparate systems with one collaborative solution, improving transactional efficiency between businesses.

This article is for general information purposes only. Consult a qualified financial advisor regarding any changes to or decisions about your business’s finances.