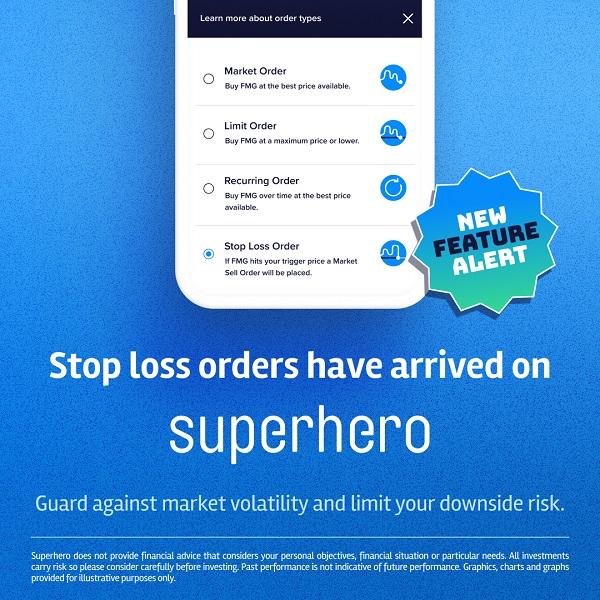

Superhero releases Stop Loss feature

Superhero, a leading share trading and superannuation platform has today released its first conditional order option via a Stop Loss feature, allowing investors to limit losses and minimise their downside risk for Australian trades.

Superhero’s Stop Loss feature is the first conditional order feature available on the platform with others including Take Profit orders to come. By implementing a Stop Loss order with Superhero, investors will be able to sell their Australian stocks if the price falls to or below a certain level, called the ‘trigger price.’

From today, Superhero investors will be able to place Stop Loss Orders for any Australian share or ETF on Superhero simply by:

- Choosing a holding from their portfolio and selecting ‘Sell,’ and then ‘Stop Loss Order’ as the order type.

- Setting the trigger price. This is the price at or below which their shares or ETF units will begin to sell.

- Choosing the number of units they would want to sell in case the price falls to or below the trigger.

- Tapping ‘Review’ and submitting the order!

Superhero investors can always edit or delete the order from their Dashboard under the ‘Pending’ tab.

CTO and co-founder of Superhero, Wayne Baskin, said the new feature demonstrates Superhero’s commitment to supporting its investors in growing their wealth.

“We’re very pleased to announce that Superhero investors will now have access to a Stop Loss order feature. This feature has been one that our investors have been asking for and one we’ve had in the works for a while now. In times of market volatility, having access to a Stop Loss feature for Australian stocks will support our investors in limiting downside risk, such as in situations like market selloffs.”

Baskin continued, “Keeping our investors at the heart of everything we do at Superhero has been key to our success in the market over the last two years. We’ll continue adding new features to our platform to ensure that our customers have the best possible experience investing with Superhero.”

For more information, please see the full how-to guide here.