Travel, electric cars and a BNPL boom: Superhero reveals its most traded stocks of 2021

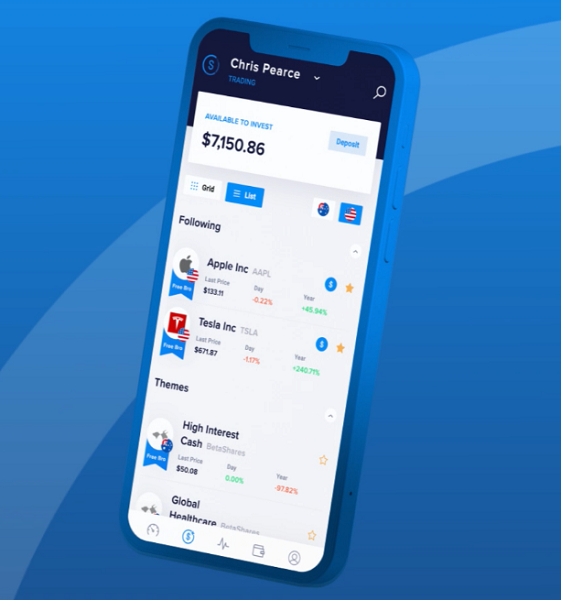

Superhero, a leading share trading and superannuation platform, has today released its first annual Year in Trades review, digging into the most-traded assets on its platform in 2021.

With over 150,000 customers, up from 22,000 customers in December 2020, Superhero’s platform sees thousands of trades every day with customers investing across all sectors – from technology and buy now, pay later to resources and retail.

The top five most traded Australian companies between 1 January 2021 and 30 November 2021 (inclusive) were:

CEO and Co-Founder of Superhero, John Winters said, “Despite 2021 being yet another challenging year for many, our customers continued to invest with gusto. We saw increased trades not only month-on-month but also week-on-week as Aussies flocked to the market to grow their wealth.

“There was a clear trend across both Australian and U.S. shares that Superhero customers invested in the brands they interacted with regularly. From Qantas and Kogan in Australia to Apple and Tesla in the U.S. – our customers invest in what they are invested in personally.”

On the buy now, pay later battleground, Zip Co (ASX:Z1P) reigned supreme in 2021 as the most-traded Australian stock over rival Afterpay (ASX:APT). The Commonwealth Bank of Australia (ASX:CBA) meanwhile was the most-traded Big Four bank, ahead of rivals Westpac (ASX:WBC), ANZ (ASX:ANZ) and NAB (ASX:NAB).

Lithium battery company Novonix (ASX:NVX) took home the title of the hottest Australian tech stock among Superhero investors, and is soon to enter the ASX 200 index in December. Fortescue (ASX:FMG), Pilbara Minerals (ASX:PLS) and Vulcan Energy (ASX:VUL) not only ranked as the most-traded resource companies (in that order), but all cracked the top 10 Australian shares overall.

Heading into the holiday season, Kogan (ASX:KGN) was named the most-traded Australian retail stock on Superhero this year.

Over on Wall Street, tech companies dominated with Tesla (NASDAQ:TSLA), Apple (NASDAQ:AAPL), Lucid Motors (NASDAQ:LCID), Rivian (NASDAQ:RIVN) and Alibaba (NYSE: BABA) rounding out the top five most-traded listed companies on Superhero’s platform.

“Aussie investors quite clearly see the value of electric vehicles – to have three EV companies be in the top five most traded U.S. companies is huge. Tesla has led the charge for years but seeing Lucid Motors and Rivian also make the list showcases how Superhero customers back electric vehicles as the future. Rivian in particular is an interesting one, being a favourite among investors despite only listing in mid-November,” commented Winters.

“Our customers have backed electric vehicles and from an ETF perspective, the Global X Funds Autonomous & Electric Vehicles ETF (NASDAQ: DRIV) was the most traded U.S. ETF this year.”

Winters continued, “While our customers do tend to look to local companies first when investing, we have seen a steadily growing interest in investing in global markets and companies in 2021. When it comes to ETFs, not only are they a great way to gain exposure to a range of different companies and industries but our customers have used them to dip their toes into global markets.

“For example, the BetaShares NASDAQ 100 ETF (ASX:NDQ) and the BetaShares Asia Technology Tigers ETF (ASX:ASIA) were the first and second (respectively) most traded Aussie ETFs in 2021. Both of these ETFs give investors the opportunity to gain exposure to some of the biggest companies in the world in a single transaction.”