82% of BNPL users favour the split payment platform at checkout

The 2022 Mozo Buy Now Pay Later (BNPL) Report has found that 82% BNPL users admit they are turning to the platform when shopping online as it’s more convenient to login to their account, than entering credit or debit card details.

When shopping online, 44% of BNPL users like the ability to enter their login details and not be slowed down by other check methods. One quarter (25%) of BNPL shoppers admit they often don’t have their card details with them when shopping online, so opt for the payment platform login.

“Buy Now Pay Later platforms can be a great way to break down the cost of more expensive items and manage your personal budget. With online shopping skyrocketing in popularity, it’s no surprise that people are using the split payment systems to further streamline their checkout process. However, this convenience could come at a cost, if you don’t manage your repayment schedule and incur late fees,” says Claire Frawley, Mozo Spokesperson.

While buying items online can be secure, there are still scams and phishing sites trying to obtain credit card information. 13% of respondents favoured logging into their BNPL platform as a way to avoid entering credit card details while shopping online.

How much are we spending on BNPL?

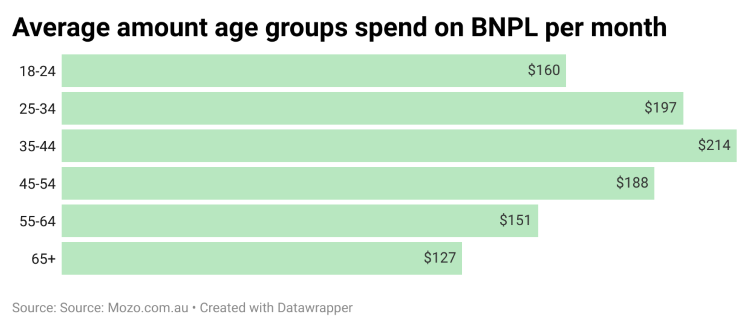

Australians are spending $2,208 annually on BNPL platforms, which is $184 on average per month. In contrast to popular belief, Gen X spends 25% more on average than Gen Z. Those aged between 35-44 years spend $214, whereas those who are 18-24 years only spend $160 on average per month.

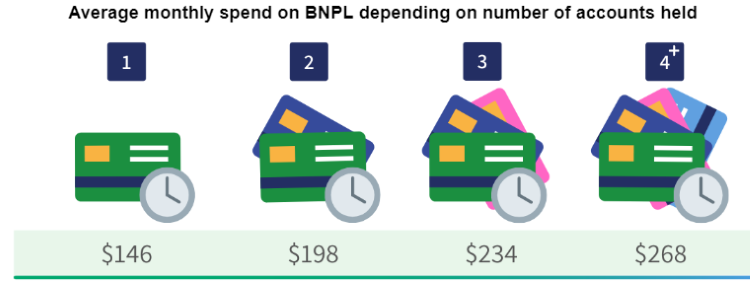

Mozo found that people with more accounts spent more per month than people with just one account. The research found that people with just one account spent $145 on average a month, while those with three accounts spent $234 on average.

What are Australians buying with BNPL?

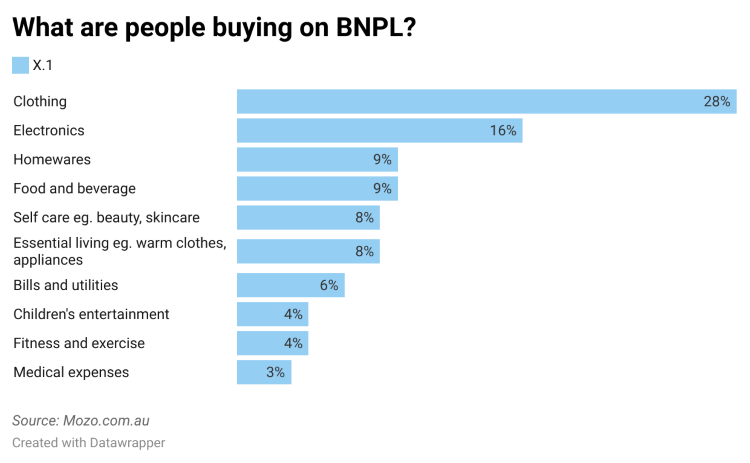

When it comes to items people are purchasing with BNPL platforms, clothing (28%) is still the most popular category, followed by electronics (16%) and homewares (9%).

Although the responses were low, a portion of society is using the split payment systems to pay for more critical services, like bills or utilities (6%) and medical expenses (3%).

“Many BNPL platforms now offer the ability to use their payment service at any retailer or service provider. Some providers do this by offering one-off disposable digital cards that allow you to make a purchase on BNPL, even if that retailer doesn’t offer the service.”

When are Aussies choosing to use BNPL?

One-in-five users preference the split payment platforms everywhere they can, as they like to use it as their main payment platform. This is in contrast to 17% of users who only use BNPL when they don’t have enough money left after pay day.

“As buy now pay later grows in popularity and is available in more places, some users are splitting payments everywhere they can. If you fall into this category, it’s important to keep track of your spending and don’t miss repayments that can end up in late payment fees.”

Just under half (40%) of BNPL users turn to the service when they are buying a ‘fun purchase’ or when buying expensive items, to make them more affordable.

“Interestingly, BNPL customers turn away from the platform when they can buy the item outright (47%) or they have just been paid (34%). Showing that many users use the platform in a responsible way to manage their money,” says Frawley.

One-in-three BNPL customers do not use the platform when they have multiple items on their account already, opting for a different payment method.