Introducing Australian FinTech’s newest Member – Quickli

Quickli is currently being used by more than half of the brokers in the country and by all of the top brokerages in the country.

Aussie fintech Zepto launches PayTo Index, revealing real-time payments momentum

Zepto has today launched its inaugural PayTo Index, mapping Australia’s PayTo adoption as the nation’s payment ecosystem undergoes a seismic shift.

Stryd and Experian to launch Open Banking powered loan-matching solution for brokers

Experian has announced a new collaboration with fintech platform Stryd providing real-time transaction data and product insights to the Australian mortgage market.

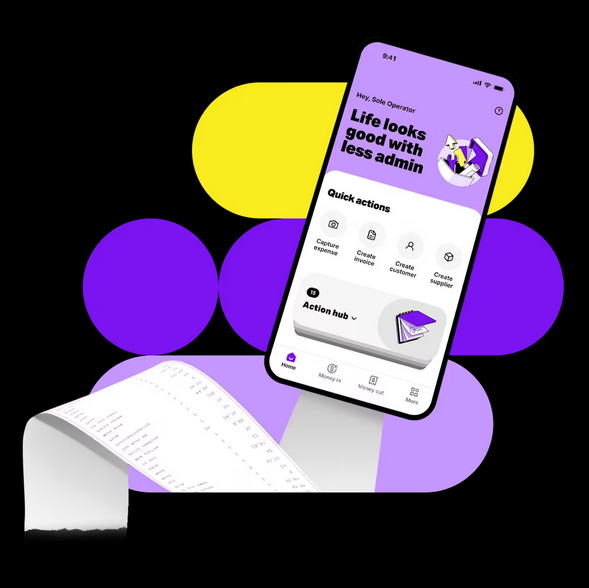

MYOB moves into banking services with the launch of Solo Money

MYOB have launched its embedded finance feature – Solo Money – a business transaction account in Solo by MYOB.

Briefcase’s multi-asset ETF portfolios receive first SQM Research rating

Briefcase has received a 3.75-star “Favourable” rating from SQM Research for its Multi-Asset ETF Model Portfolios.

CareSuper and FNZ partner to launch enhanced Direct Investment Option platform in Australia

CareSuper and FNZ have partnered to bring an enhanced Direct Investment Option (DIO) platform to CareSuper’s members.

DigitalX secures over $20 million via a strategic placement to expand its Bitcoin strategy

ASX-listed DigitalX Limited have raised approximately $20.7 million via a strategic placement to global digital asset investors.

10th Annual FinTech & Banking Awards: 1 week left for submissions!

Australia’s first and oldest FinTech & Banking Awards, the 10th Annual FinTech & Banking Awards 2025, has just 1 week left for submissions.

The curious stagnation of payment card innovation

Since the introduction of the payment card in the mid-20th century, the payments industry has seen surprisingly few transformative innovations.

Five transaction monitoring pitfalls that keep FinCrime teams up at night

ThirdEye has identified five critical mistakes that continue to trip up financial institutions when implementing transaction monitoring systems.