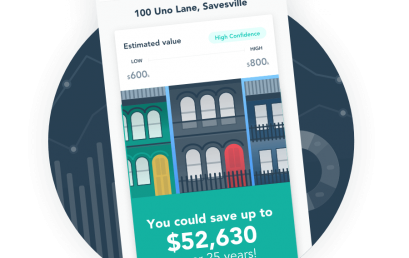

uno cracks the formula for 10-minute home loan recommendations

Online mortgage broker uno Home Loans has introduced technology that delivers refinancers a credit proposal for a cheaper home loan in the time it takes to drink a coffee. Watch the video here. The new refinancing pathway on uno’s platform digitises the process to combine a property valuation; ID verification; instant credit check; collection of current loan details; verification of income, expenses and liabilities; and assessment with credit policies from nine lenders. This expedited process – which would take days with a traditional broker – addresses a major barrier to more Australians refinancing and saving. uno Home Loans Founder and Chief Innovation Officer Vincent Turner said, “Many Australians know they […]

Afterpay’s shares recover as the fintech backs greater regulation of buy-now-pay-later consumer lending

Payments fintech Afterpay, whose shares were hit hard after a Senate inquiry was formed to investigate consumer lenders not covered by the financial services royal commission, says it supports “appropriate regulation” and oversight by corporate regulator ASIC. The company says its buy-now-pay-later model is different to traditional credit, a fact recognised by the New Zealand Government when it recently decided not to include products such as Afterpay in local credit regulations. “Afterpay welcomes the opportunity to participate in any review to ensure an informed discussion takes place in an appropriate forum and that the differentiated nature of Afterpay’s service is clearly understood,” the company said on a statement. The fintech […]

Open banking: Refinance in 15 minutes

Open banking could see borrowers refinancing their home loans in 15 minutes, according to one panellist at a recent fintech summit. The event, held in Sydney on Tuesday (16 October), focused on how digital innovation was changing finance. The program included speakers and panel discussions on topics such as challenger brands, neo-banking and open banking. One panel session on challenger brands and neo-banks discussed the future of open banking. Panellists included CEO of VOLT bank, Steve Weston, and chief marketing officer of Athena Home Loans, Natalie Dinsdale. Athena Home Loans is still in a soft pilot phase, but Dinsdale said its “mission is to own home loans”. Other panellists were […]

ANZ in global banking consortium to digitise trade finance

ANZ Banking Group has joined forces with six global banking giants to create the “Trade Information Network”, which the lenders say will accelerate the digitisation of traditionally paper-based processes to unlock billions of dollars of funding for global exporters. “The network has the potential to transform international trade,” the banks said in a media release issued on Thursday, ahead of its official unveiling at the massive Sibos conference in Sydney on Monday. The other members of the new network are: Banco Santander, BNP Paribas, Citi, Deutsche Bank, HSBC and Standard Chartered. The banks want to develop a new industry standard for trade finance, which has been in a challenging period […]

Lendi announces co-major sponsorship of the West Coast Eagles

Online home loan platform Lendi, has announced a new partnership as co-major sponsor of 2018 AFL premiership winner, the West Coast Eagles Football Club.

Nimble checks in with QPC for Genesys PureCloud customer experience deployment

QPC, the specialist contact centre services and solutions company, has been awarded a contract to deploy and support the Genesys™ PureCloud™ all-in-one cloud customer engagement and collaboration contact centre platform at Nimble, a leading national online personal financial loans company. Based out of Melbourne and the Gold Coast, Nimble has provided over 1.4 million loans. The company provides customers with decisions on loan approvals within minutes of a submitted application across any device. The decision to deploy PureCloud is part of a company-wide strategy to transition to a digital business and replace its legacy IT infrastructure with cloud technology to better service the changing behaviour of its customers who increasingly […]

Afterpay, Zip await ASIC critique of buy now pay later

An in-depth investigation into the often controversial buy now pay later industry by the corporate regulator that will assess whether new laws are needed to protect consumers will be made public in December, as new criticism is levelled at the model of local giant Afterpay Touch Group. Sources told AFR Weekend the Australian Securities and investments Commission was putting the finishing touches on its deep dive into the sector in readiness for a late-2018 release, after it came up against some delays. The regulatory review kicked off earlier this year, with the aim of determining whether the industry needed further regulation, whether customers were at risk of harm or were […]

Personal loans: Young borrowers desert banks for better deals

Borrowers are turning away from traditional banks when applying for personal loans, flocking to digital, mobile-centric platforms and peer-to-peer lenders. A recent CommSec Economic Insights report showed loans by non-bank financial institutions were up 10.3 per cent for the year to August. This was an indication that banks were engaging in “more considered” lending and borrowers had other options, according to CommSec chief economist Craig James. “Banks are facing greater competition from non-banks,” Mr James said. “At the same time bank deposits are only lifting at a 2.5 per cent annual rate, putting greater reliance on external funding. It is clearly a competitive and challenging environment for financial institutions.” Peer-to-peer […]