Effi launches exclusive lite version for Australia’s largest community of mortgage brokers

Effi has announced a new partnership with Finance & Coffee, Australia’s largest community of mortgage brokers, lenders and loan processors.

Help customers repay loans with financial data

Innovators can take advantage of the ongoing access to financial data to retain and nurture customers out of financial hardship.

Lend welcomes Butn to panel

Australian business lending platform Lend has welcomed cash flow financier Butn to its panel of lender partners.

Best Interest Duty: new survey reveals what brokers really think

A survey of mortgage brokers from HashChing has revealed the state of broker sentiment on the recent Best Interest Duty obligation.

Envestnet | Yodlee launches new Credit Accelerator solution to support faster and more accurate lending decisions

Envestnet | Yodlee today announced the launch of its Australia and New Zealand-specific responsible lending product, Credit Accelerator.

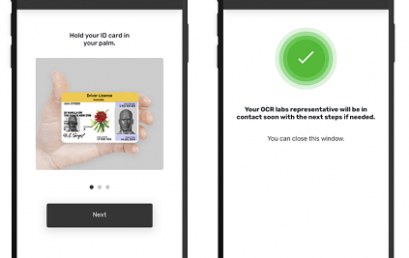

86 400 partners with OCR Labs to streamline broker and customer experience

86 400 is implementing a new identity system from OCR Labs to further streamline both the customer and broker experience.

Effi celebrates successful completion of pilot with RateCity partnership

Effi has partnered with RateCity to enable brokers to build a brand profile as a trusted broker on the high traffic RateCity website using the Effi platform

Bizcap enjoys month-on-month double-digit origination growth throughout COVID and 275% growth in 12 months

During the pandemic, Bizcap has been able to help hundreds of SMEs, with their funding space growing over 275% in the past 12 months.