MoneyMe secures $50m funding from Pacific Equity Partners

MoneyMe has formed a strategic funding partnership with Australian investment firm Pacific Equity Partners, securing an initial $50m funding commitment.

loans.com.au strengthens car loans offering with launch of car buying service OnlineAuto.com.au

Car buying service OnlineAuto.com.au has officially launched to address a common pain-point of buying a car in the current market.

Australia’s mortgage brokers expect house prices to rise: Hashching survey

Hashching has revealed that almost 60% of survey respondents agree that house prices will exceed 20% growth by the end of the calendar year.

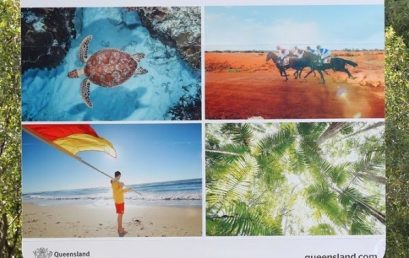

SocietyOne continues to grow broker team and expands into Queensland, as broker originations double

SocietyOne has invested further into its broker channel with new appointments in New South Wales and a newly-launched Queensland team.

100 million reasons to use non-bank disruptor TechLend

Just two months since launching non-bank lender TechLend has already reached $100 million in bridging loan applications.

Lending is surging – But what does it all mean?

A comprehensive insight into lending indicators by Savvy late last August showed that housing lending is booming.

OnDeck gives small businesses a break to take back their time

OnDeck Australia is supporting the cashflow needs of the nation’s small businesses by offering a 4-week repayment holiday to new and renewal loans.

Bluestone Home Loans’ brokers reap digital revamp rewards

Bluestone Home Loans has introduced NextGen.Net’s ApplyOnline Application Centre as a key integration in their newly overhauled digital lending platform.