Lumi joins COG Aggregation and Platform Finance’s lender panels

Lumi has joined the lending panels of COG Aggregation and Platform Finance, giving brokers a broader range of innovative funding solutions to better serve their SME and self-employed clients.

Funding bolsters its BDM team

Funding has bolstered their NSW BDM team, welcoming Lauren Severino and Sam Hermon to service the growing need for bridging and construction lending in the state.

Centrix delivers financial data win for New Zealand borrowers and lenders, powered by Envestnet® | Yodlee®

In a win for New Zealand borrowers and lenders, Centrix will be switching on live bank data feeds, powered by global data aggregator Envestnet®| Yodlee®.

Inaugural Banjo Barometer Report reveals 30 per cent spike in SME loan applications

Manufacturing, retail and transport businesses fuelled a surge in loan applications in the first quarter of FY24 according to the first Banjo SME Business Barometer Report.

Fifo Capital innovates SME finance, earns high commendation at Finder Awards

Fifo Capital have announced its recent recognition with a high commendation in the “Best Lending Solution” category at Finder’s Innovation Awards.

ScotPac doubles online Boost Business Loan cap to $500,000

ScotPac has increased the limit of its online Boost Business Loan product from $250,000 to $500,000 in response to strong borrower demand.

Banjo Loans sees 250% increase in loans to healthcare sector

Banjo Loans has increased loans to the healthcare and social assistance sector by 250% in the past six months, fuelled partially by pharmacy fitouts for new high-tech shops.

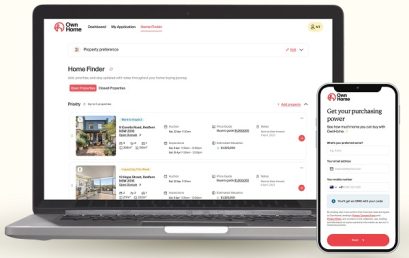

OwnHome launches Australia’s first 0% deposit home loan option to get more people onto the property ladder

CBA-backed OwnHome today launched the Deposit Boost Loan – an Australian first that will help aspiring buyers secure a bank loan with 0% deposit.